Individuals are elected to a Tribal council, Tribal board of directors, or equivalent positions because of a variety of skill sets that bring different viewpoints to the table and add value to a Tribal government or Tribal organization. However, those skill sets don’t always include an accounting or finance background.

Tribal councils must know the difference between their restricted resources and unrestricted resources. Funding from grants and contracts must be used for specific purposes, but there are other sources of funding used based on strategic decisions made by the Tribal council.

The following guidance is provided for Tribal council members to consider when reviewing their Tribe’s financial statements.

Your Financial Position

The amount of cash in the Tribe’s bank account isn’t a true indicator of your Tribe’s financial position.

Ask your chief financial officer, controller, or equivalent, to show you the Tribe’s month-to-date or year-to-date financial statements. It’s best to review the current period and prior period financials side-by-side to easily identify and inquire about any significant fluctuations.

Specifically for revenues and expenses, seeing a trend of the past three to five or even 10 years will tell you the story of the direction of the Tribe’s financial position.

Know Your Resources

When you’re reading through the financial statements, you’ll see your Tribe’s financial resources are primarily split between the following:

- Unearned revenues

- Unrestricted net position

- Revenues

Unearned Revenues

Tribes typically have unearned—or deferred—revenues, which is advanced cash received by granting and contracting agencies. If there are large, advanced cash balances that haven’t been spent year-over-year, also referred to as carryover balances, you’ll want to find out whether there are projects planned for that funding to ensure your Tribe is seizing opportunities with the available funding.

Unrestricted Net Position

Unrestricted net position—also considered unrestricted equity—is a line item on your financial statements that indicates the amount of savings the government has built up over the years that can be used at the discretion of the Tribe.

The purpose of a government isn’t to make a profit, but to provide services and take care of its citizens. So as a Tribal council member, you’ll want to evaluate if the government has a balanced strategy for this unrestricted net position to:

- Address current and long-term needs of citizens, including future expansion of programs and services

- Utilize future economic development opportunities

- Maintain sufficient funds for reserves, such as replacement of infrastructure or emergency situations

Revenues

Familiarize yourself with the different sources of revenue to have an idea of which are the more reliable revenue sources—for example, continuing Bureau of Indian Affairs (BIA) and Indian Health Service (IHS) contracts—and which ones tend to fluctuate based on economic conditions, such as investment income and sales tax revenues.

If you find most of your larger revenues are made up of one or two limited sources, such as federal grants and contracts, or profit distributions from one Tribal enterprise, it’ll give you an area of focus to create a long-term strategy to diversify your revenue sources and reduce your concentration risk.

Reviewing your revenues and expenses in a budget versus actual format will give you an idea of the Tribe’s current year-to-date financial results.

Make Connections in the Financial Statements

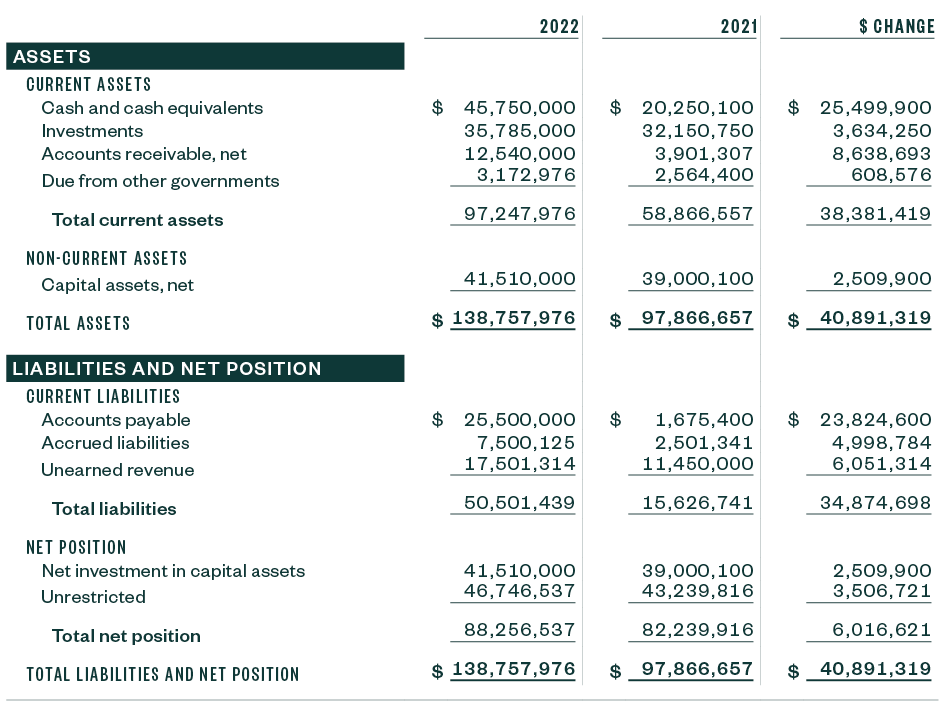

In the example below, you’ll see a significant increase in cash balances. But, pay attention to the significant increases in receivables, which consist of amounts the Tribe is owed from other parties and grant awarding agencies, and significant increases in accounts payables and other liabilities, which consist of amounts the Tribe owes to vendors, employees, and other parties.

Year-to-Date Financial Statements Example

Although cash balances have increased, so have accounts payable and accrued liabilities that are payable within a year. As a result, the increase in cash is most likely a timing difference, since that increase in the cash balance will be used to pay outstanding vendor invoices and employee obligations in 2023. The increase in cash is also related to an increase in advanced cash received from granting agencies, called unearned revenue.

Normally, you’d expect receivables and payables to fluctuate month by month based on the amount of collections received and payments made. But, if receivables or payables are consistently growing each month, or if these balances are unusually large in relation to the respective revenues or expenses, you’d want to know how long the receivables and payables have been outstanding.

If the receivables are greater than 90 days old, there’s an increased risk you’ll be unable to collect the cash on those balances. For long outstanding payables, you’d want to ensure there are no unnecessary penalties or interest charges the Tribe has to make on late payments.

Expenses

As you consider your citizens’ needs while reviewing the financial statements, look carefully at expenses. Understand the total expenses and check for alignment with Tribal needs, then break down each program’s expenses by type.

Understand Your Costs

Review the expenses by each general fund program and grant program operated by the Tribe to get familiar with the cost of your programs and consider whether these programs align with your citizens’ needs.

Ask for an Expense Breakdown

Within those expenses by program, you’ll want to ask for a breakdown of the expenses by three general areas:

- Operating expenses broken out between payroll and non-payroll operating expenses

- Capital expenses, typically one-off capital purchases, construction expenses, or non-recurring expenses

- Indirect cost expenses

Payroll and Operations

During difficult economic conditions, understanding the composition of your payroll versus non-payroll expenses will inform your strategic decisions.

While capital projects can be delayed and other program operations can be trimmed, it’s helpful to know the number of employees operating the Tribe’s programs. Attracting, retaining, and training good talent is big challenge for every organization.

Indirect costs, such as administrative costs, is an indication of how much effort it takes your Tribe to operate a program. Knowing the burden of your indirect costs when evaluating a new grant opportunity will tell you about the cost versus benefit of the grant program.

Training

Each Tribe’s finances are unique, so while our guidelines pertain to Tribal financial statements in general, it’s prudent to create financial statement training either for newly elected Tribal council members or provide refresher trainings to all Tribal council members every few years.

We’re Here to Help

To learn more about financial statements for Tribes, contact your Moss Adams professional. You can also read our article on Key Governance Concepts Every Tribal Council Member Should Know or visit our Tribal & Gaming page.