Colorado county assessors are required to appraise all real property every two years for property tax purposes. All Colorado property owners and taxpayers received another mailing of notices of valuation by May 1, 2023.

Significant value increases were expected with most subclasses of real property throughout the state. Residential property was valued by the county assessor’s use of a market approach or sales comparison approach. Actual values assigned to commercial properties are a result of the assessor’s consideration of the cost, market, and income approach to value.

An actual value assigned to real property is a key component of property taxation. One major step for property owners and taxpayers is to review and analyze the actual values from the notice of valuation.

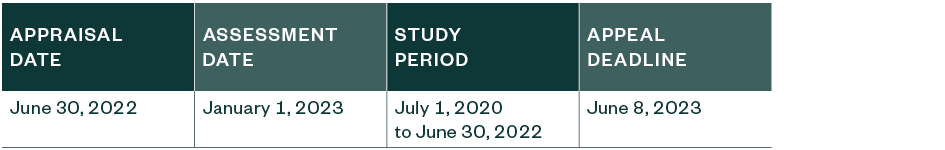

Colorado taxpayers may exercise the right to appeal the valuation or classification of real property. If a property owner determines the assessor’s valuation to be excessive, an assessment appeal must be filed no later than June 8, 2023. Appeals may be submitted to the county assessor in person or in writing. Informal meetings with the assessor must also be completed by June 8, 2023.

If necessary, taxpayers may file appeals beyond the assessor level to the county board of equalization and state board of assessment appeals to achieve tax savings. Notices of Determination or decision notices are issued at each of these appeal levels to notify the taxpayer of the appeal results. Taxpayers have 30 days from the issuance of these notices to file additional appeals to protect and preserve their appeal rights.

Taxpayers who successfully challenge their assessments may realize real estate tax savings that reduce their property’s operating expenses and improve the property’s net operating income.

If a property owner doesn’t submit a written objection by June 8, the appeal rights are still considered available, through the abatement or refund procedure. These abatement petitions can be filed with the county after taxes have been levied in January. Taxpayers have two years from the time taxes are levied to file abatement appeals.

Counties may elect to expand the assessor’s time to answer protests from the last regular working day in June to August 15. In counties that have made this election, appeals concerning income producing commercial property require taxpayers to submit tenant rent rolls, income, and expenses by June 15.

Important Dates

We’re Here to Help

For more information and tips for reducing real property tax liabilities, contact your Moss Adams professional.