The IRS published Notice 2023-44 on May 31, 2023, providing additional guidance and clarification to the prior alert outlining initial guidance under the Internal Revenue Code (IRC) Section 48C(e) program.

Highlights

Notice 2023-44 expands upon general guidance for IRC Section 48C(e) initially published in Notice 2023-18, including:

- Definitions of the term facility for purposes of IRC Section 48C

- Clarification regarding projects placed in service prior to being awarded an allocation

- Process of submitting concept papers and joint applications for Department of Energy (DOE) recommendations and for IRC Section 48C(e) certifications

- Energy communities census tracts

- Selection criteria used to evaluate whether a project merits DOE recommendation

- Procedures for informing the IRS and DOE of a significant change in plans for a project that received an allocation

Notice 2023-44 republishes Appendices A and B included in Notice 2023-18 with certain modifications. Appendix A clarifies definitions, and Appendix B provides technical review criteria and application content requirements. Appendix C is new and provides a list of IRC Section 48C(c) energy communities census tracts.

Expanded Guidance

Below is an explanation of terms and processes included in the new guidance.

Terms Defined

- Facility: Refers to the eligible property that makes up the qualified investment included in the qualifying advanced energy project

- Eligible property: Generally defined as tangible personal property subject to depreciation and integral to an otherwise qualifying facility

- Placed in Service: Company won’t receive a 48C allocation if eligible property is placed in service prior to being awarded an allocation

Submission Process

Notice 2023-44 expands on the application process in Notice 2023-18, with some notable changes being outlined below:

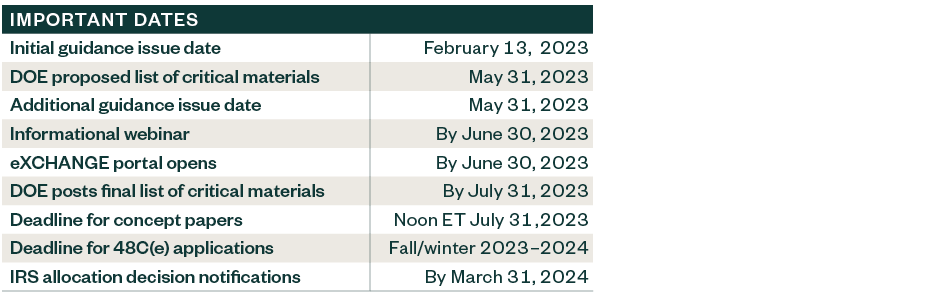

- Concept paper must be submitted before noon eastern time July 31, 2023, through the eXCHANGE portal, which will open no later than June 30, 2023

- IRS will make all round one allocation decisions by March 31, 2024

- Applicants may not place facilities in service before receiving the allocation letter

- DOE will notify the taxpayer and IRS that it received the taxpayer’s notification that the IRC Section 48C facility has been placed in service within the required two-year period

- Credit can be claimed on the federal income tax return for the taxable year when the IRC Section 48C facility was placed in service

- Formal notification through the eXCHANGE portal is required to withdraw the application

Energy Communities Census Tracts (ECC Tract)

Of the $10 billion of credits that can be allocated through the IRC Section 48C program, $4 billion is allotted for qualified investment located in ECC tracts. The DOE will review projects to determine if they’re located within the designated tracts.

Footprint Test

The facility is treated as located within an ECC tract if it satisfies the footprint test. The footprint test provides that a facility is considered located within an ECC tract if 50% or more of the facility’s square footage is situated within the qualifying ECC tract.

Selection Criteria

The DOE will evaluate projects based on the following:

- Domestic job creation, both direct and indirect

- Net impact in avoiding or reducing air pollutants or anthropogenic emissions of greenhouse gases

- Potential for technological innovation and commercial deployment

- Cost of generated or stored energy, or of measured reduction in energy consumption or greenhouse gas emission

- Project time from certification to completion

Technical Review Criteria

The DOE will base its recommendations on the following four criteria:

- Commercial viability

- Greenhouse gas emissions impacts

- Strengthening US supply chains and domestic manufacturing for a net-zero economy

- Workforce and community engagement

Significant Change in Plans

If a taxpayer has a significant change in plans compared to its concept paper, they must upload a letter to the Exchange portal notifying the DOE and IRS of these changes.

Appendix A and B in Notice 2023-44 supersede the appendices in Notice 2023-18. Appendix B provides very detailed instructions on the application process, concept paper criteria, application preparation, and submission process.

We’re Here to Help

For more information on how this guidance could impact your business or if you have questions related to Tax Credits & Incentives, contact your Moss Adams professional.