The importance of Sarbanes-Oxley Act Section 404, or SOX 404, for public companies cannot be overstated—it safeguards the interests of investors and the public by enhancing corporate governance and financial reporting transparency.

SOX 404 helps establish a framework for public companies to strengthen their internal control systems, so potential risks and weaknesses are identified, mitigated, and disclosed appropriately.

SOX Compliance

By complying with SOX 404, public companies demonstrate commitment to sound corporate governance and integrity. Establishing a strong control environment helps reduce the likelihood of fraud, misappropriation of assets, or other financial irregularities.

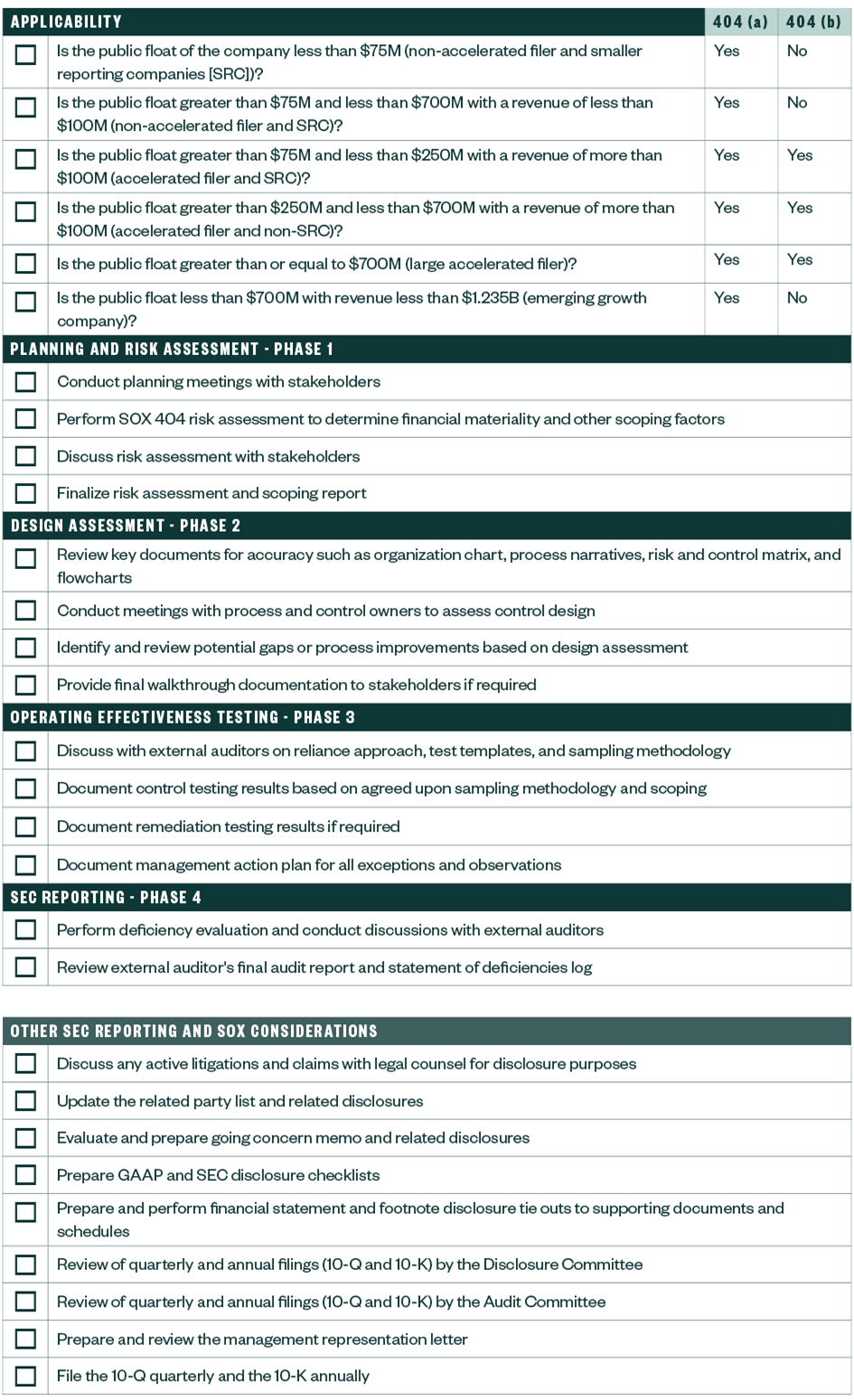

The following checklist provides guided insight for the process of achieving SOX compliance in your organization.

SOX Compliance Checklist

We’re Here to Help

If you have further questions regarding SOX compliance, we have a selection of resources to help you get started. Explore more information surrounding SOX 404 compliance by reaching out to your Moss Adams professional