The Financial Accounting Standards Board (FASB) issued proposed Accounting Standards Update (ASU), Income Statement—Reporting Comprehensive Income—Expense disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses.

The proposed ASU would require public business entities (PBEs) to provide detailed disclosure in the notes to the financial statements of specified expense categories underlying certain income statement expense line items in both annual and interim periods.

Comments are due October 30, 2023. The FASB will host a public roundtable on December 13, 2023, to obtain additional feedback on the proposed ASU.

Key Provisions

The proposed ASU is intended to address investor requests for further disaggregation of expenses in commonly presented income statement expense line items such as cost of sales, selling, general, and administrative expenses (SG&A), and R&D.

While companies may be subject to certain industry specific requirements, such as income statement presentation requirements for commercial and industrial companies in accordance with Regulation S-X, under current US generally accepted accounting principles (GAAP), there isn’t a broad—or industry neutral—requirement to disaggregate income statement expenses.

This leads to diversity in the amount of disaggregated expense information provided by companies.

The proposed amendments wouldn’t change or remove existing expense disclosure requirements but rather expand expense disclosures by requiring PBEs to disaggregate all relevant expense captions. Expenses would be disaggregated into the following expense categories in a tabular format in the notes to the financial statements on an annual and interim basis:

- Inventory and manufacturing expense

- Employee compensation

- Depreciation

- Intangible asset amortization

- Depreciation, depletion, and amortization recognized as part of oil- and gas-producing activities

A relevant expense caption would be an income statement expense line item within continuing operations containing one of the above expense categories.

The proposed amendments clarify that an income statement expense line item including the amortization of a finance lease right-of-use asset or the amortization of leasehold improvements would be subject to further disaggregation as these amounts would be considered a subset of either depreciation or intangible asset amortization.

Inventory and Manufacturing Expenses

Inventory and manufacturing expenses are defined as expenses that comprise both inventory expense and other manufacturing expenses, if applicable.

Inventory Expense

The proposed ASU defines this as “an expense resulting from the derecognition of inventory due to sale to customers, consumption in the production of goods or services for such sale, or remeasurement (for example, an impairment) in accordance with Section 330-10- 35 or any other Subsequent Measurement Section within an Industry Subtopic in Topic 330 on inventory.”

Other Manufacturing Expenses

These include certain costs incurred as part of the company’s manufacturing activities that aren’t capitalizable

On an annual basis, a public company would disclose its definition of other manufacturing expenses for the purpose of disaggregating inventory and manufacturing expense.

Employee Compensation

Employee compensation expense would include all forms of cash consideration—including deferred cash compensation—and noncash consideration, such as share-based payment awards, medical care benefits, pension benefits, post-retirement benefits, and nonretirement post-employment benefits given by an entity in exchange for service rendered by employees or for the termination of employment.

Inventory and Manufacturing Expenses

The proposed amendments would also require further disaggregation of inventory and manufacturing expenses into the following categories of costs incurred:

- Purchases of inventory, including purchases of raw materials

- Employee compensation, including both direct and indirect employee labor costs to the extent they relate to manufacturing activities

- Depreciation

- Intangible asset amortization

- Depreciation, depletion, and amortization recognized as part of oil- and gas-producing activities

- Costs capitalized to inventory and manufacturing expenses not included in the above categories

- Changes in inventories

- Other adjustments and reconciling items

Costs incurred would include amounts that are capitalized to inventory during the current period and amounts expensed as incurred during the current period. A company wouldn’t be required to disaggregate the nature of costs previously capitalized to inventory that were sold during the current period.

Changes in Inventories

Inventory and manufacturing expenses recognized during a reporting period and the costs incurred that are either capitalized to inventory or expensed as incurred during the reporting period will generally not be equal. The changes in inventories category is required to reconcile these amounts.

The amount disclosed for changes in inventories in the current period should equal the difference between the amount of inventory included on the balance sheet presented at the end of the prior period and the amount of inventory included on the balance sheet presented at the end of the current period.

Other Adjustments and Reconciling Items

Other adjustments and reconciling items should consist of the amounts necessary to reconcile costs incurred to expenses recognized that aren’t already disclosed. This could include the following:

- Inventory derecognized during the period that doesn’t meet the definition of inventory expense

- Amounts attributable to foreign currency translation

Other Disclosure Items

In addition to disaggregating expense captions into the above specified categories, on an annual and interim basis, the proposed amendments would require a PBE to:

- Include certain amounts already required to be disclosed under existing GAAP in the disaggregated expense table disclosure if such amounts are included in the relevant expense caption

- Describe remaining amounts in each relevant expense caption or in inventory and manufacturing expense not separately disclosed per the above requirements

- Disclose the total amount of selling expenses recognized in continuing operations

Public companies would disclose how they define selling expenses annually.

Illustrative Example

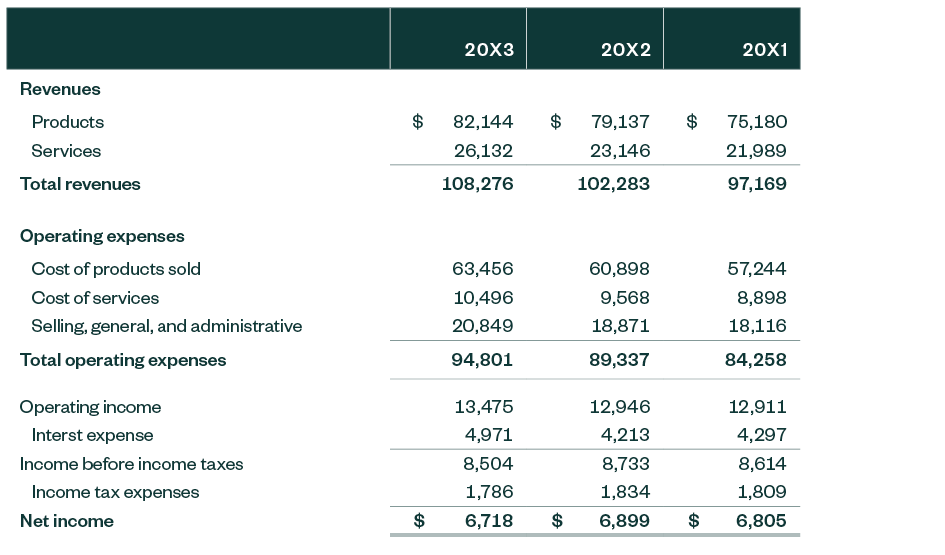

The proposed ASU includes an example for Entity XYZ to demonstrate how the proposed disclosures may look for a manufacturing company with significant service operations. The example provided in the proposed ASU includes the following consolidated statement of operations for Entity XYZ for the years ended December 31, 20X3, 20X2, and 20X1, where the entity presents cost of products sold, costs of service, and SG&A on the face of its income statement.

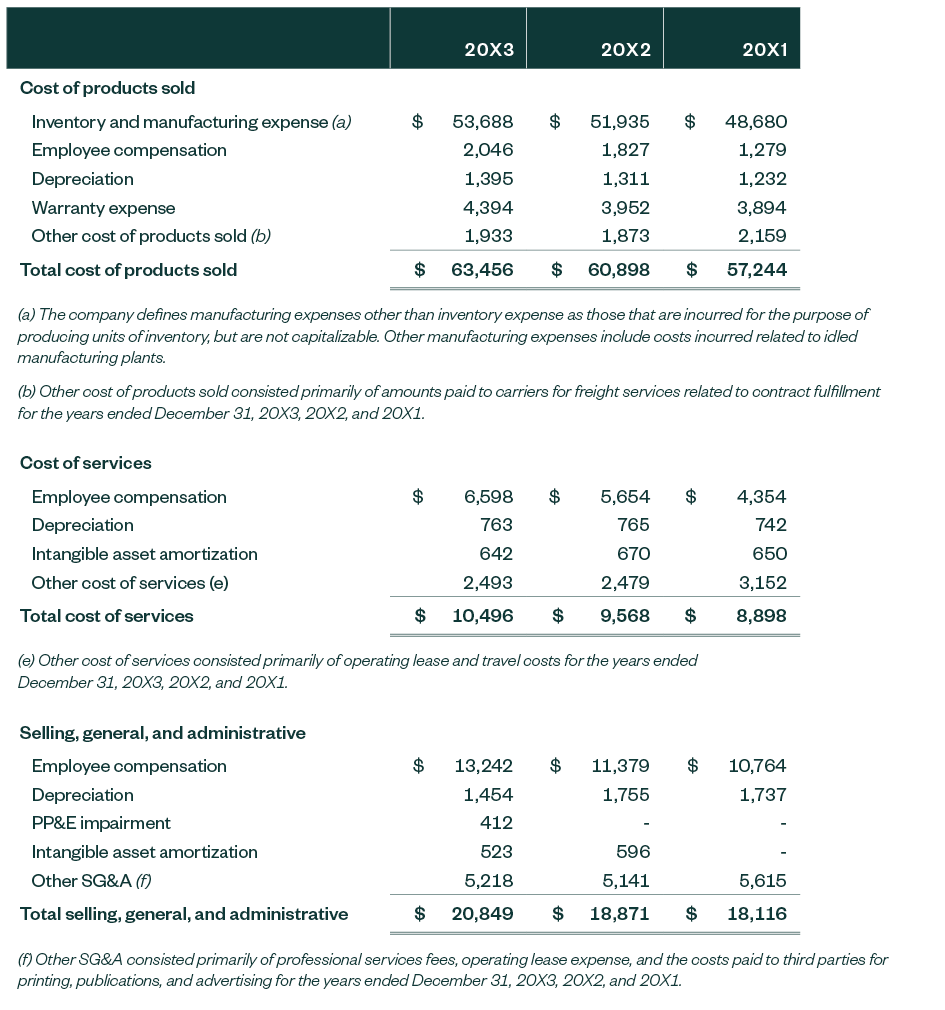

In accordance with the proposed amendments, Entity XYZ would need to further disaggregate the cost of products sold, costs of service, and SG&A into specified expense categories, as follows:

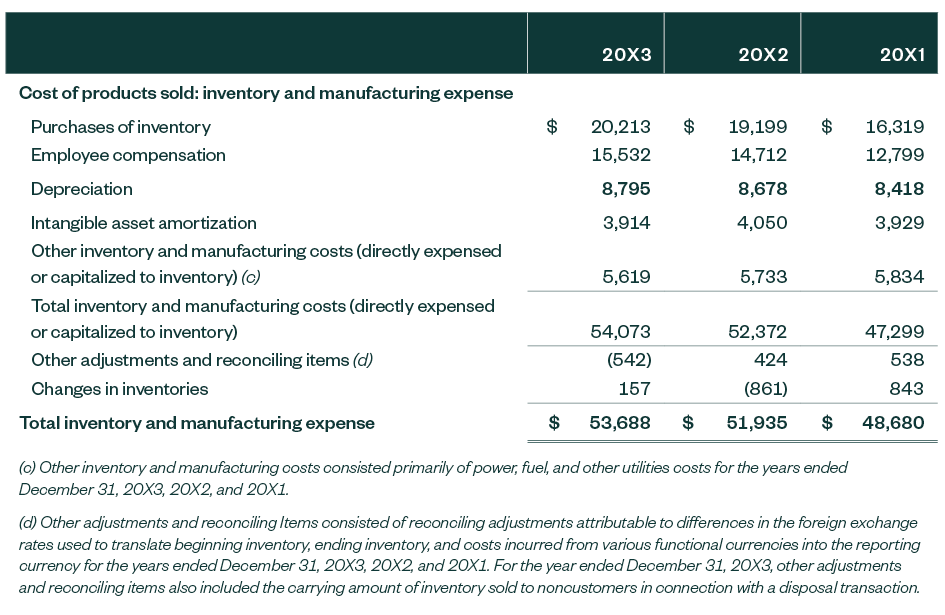

The example provided in the proposed ASU further demonstrates how inventory and manufacturing expense included in the cost of products sold would need to be further disaggregated as follows:

In addition, the example in the proposed ASU includes footnote disclosure that would be required to define selling expenses which reads, “During the years ended December 31, 20X3, 20X2, and 20X1, selling expenses were $13,425, $12,123, and $11,585, respectively. The entity’s selling expenses include those expenses related to marketing and promotional activities and client relationship management.”

We’re Here to Help

For more information on how the proposed amendments could affect your business, contact your Moss Adams professional.