Construction bond programs are often the largest expenditure of a school district’s capital and operating budget. With bond program costs ranging from millions to several billion dollars, citizens and stakeholders want to know where and how funds are spent.

Understanding California Proposition 39, its accountability requirements, and reporting best practices is essential to supporting a successful bond program.

Below is an overview of Prop 39 and actionable steps to help citizens bond oversight committee (CBOC) members effectively review construction expenditures and contribute to program success.

Proposition 39 Overview

California voters passed Proposition 39 on November 7, 2000, which amended provisions to the California Constitution and subsequently amended the California Education Code.

The purpose and intent of the initiative was “to implement class size reduction, to ensure that our children learn in a secure and safe environment, and to ensure that school districts are accountable for prudent and responsible spending for school facilities.”

The proposition resulted in the following amendments to the California Constitution:

- To provide an exception to the limitation on ad valorem property taxes and the two-thirds vote requirements to allow school districts, community college districts, and county offices of education to equip our schools for the 21st century, to provide our children with smaller classes, and to ensure our children’s safety by repairing, building, furnishing, and equipping school facilities

- To require school district boards, community college boards, and county offices of education to evaluate safety, class size reduction, and information technology needs in developing a list of specific projects to present to the voters

- To ensure that before they vote, voters are given a list of specific projects their bond money will be used for

- To require an annual, independent financial audit of the proceeds from the sale of the school facilities bonds until all the proceeds have been expended for the specified school facilities projects

- To ensure that the proceeds from the sale of school facilities bonds are used for specified school facilities projects only, and not for teacher and administrator salaries and other school operating expenses, by requiring an annual independent performance audit to ensure that the funds have been expended on specific projects only

Citizens Bond Oversight Committee Purpose

Based on California’s Education Code Section 15278, the Citizens Oversight Committee’s three core duties are to:

- Inform the public of the school district’s expenditures of bond revenue

- Actively review and report on the proper expenditures of taxpayer money for school districts

- Produce and present an annual report summarizing the committee’s findings, proceedings, and activities within the prior year

Improving Expenditure Reviews with Best Practices

Oversight committee members play a crucial role in ensuring that bond program expenditures are transparent, efficient, and in line with the intended objectives.

Here are review best practices committee members can use to effectively assess bond program expenditures.

Establish Clear Guidelines

Establishing clear guidelines and procedures for reviewing expenditures is a critical first step that provides structure and processes that can help the committee and District work efficiently and effectively together.

Create a Consistent Review Schedule

Set a regular review schedule to examine bond program expenditures. A good practice is to sample a few expenditures per meeting by requesting monthly reports or check payments and payroll. This keeps the committee’s workload, as well as the district’s, manageable and helps address issues as they arise. The cadence can be monthly, quarterly, or as determined by the committee and district, depending on the size and complexity of the program.

Review Expenditure Documentation Effectively

Thoroughly examine all relevant documentation related to the expenditures. Allowable expenditures are those directly related to the Listed Projects and school district employee labor performing administrative oversight work on the Listed Projects.

Common bond expenditures include:

- Construction contractors

- Architects

- Engineers

- Inspectors

- Third-party construction managers

- District labor

- Project management

- Union labor

- Equipment which may include third-party or contractor-owned equipment

- Materials

- Subcontractors

- Legal

The construction expenditure type determines how it’s evaluated for requirement compliance and what’s considered sufficient, appropriate evidence to support the expenditure.

There are two common high-risk areas.

Labor

Districts can’t use funds for teacher and administrative salaries or operating expenses. Specifically, the California Constitution and California Education code states “that the proceeds from the sale of school facilities bonds are used for specified school facilities projects only.”

Opinion 04-110 further clarifies that, “a school district may use Proposition 39 school bond proceeds to pay the salaries of district employees to the extent they perform administrative oversight work on construction projects authorized by a voter approved bond measure.”

Joint funded position timekeeping is a common area that may warrant further questions to confirm the appropriateness and compliance of the charges generally requiring timesheets with itemized description of duties performed to confirm compliance with the ballot language.

Change Orders

It’s important to understand the root cause of the change, such as scope modification, architect errors, or unforeseen conditions. Change orders should be approved by appropriate parties such as the district, architects or engineers, and the general contractor. Change orders should also be fully substantiated with itemized estimates and assumptions.

Additionally, California’s Public Contract Code section 20118.4 notes a school district’s governing board may authorize changes in plans and specifications and order extra work performed without competitive bidding provided the cost of the extra work to be performed doesn’t exceed the limit of expenditures allowed without bids or doesn’t exceed 10% of the original contract price, whichever is greater.

During review, also ask about:

- Use of standard practices, like competitive bidding, for procurement

- Compliance with public contracting codes

- Compliance with legal requirements for prevailing wage

- Assessing payment procedures and payment processing time to validate compliance with the California Prompt Payment Act

- Reviewing program and construction management structure, including staff and fees to ensure your program is staffed efficiently and effectively

- Use and policy for construction project delivery methods and contract types with specific emphasis on Guaranteed Maximum Price (GMP) contracts and usage of controls surrounding cost of work definitions

When reviewing expenditures, consider all these factors and documents to ensure any potential findings have sufficient and appropriate evidence to provide a reasonable basis for the findings.

Construction Delivery Methods, Construction Contract Type Selection, Cost of Work Definitions, and Right to Audit Clause

Educating your CBOC members on the technicalities within construction bonds increases their ability to effectively evaluate expenses and spot inconsistencies or issues. Here are the primary technical areas and what they include.

Common Construction Delivery Methods

Work with Bond Counsel and District Management to ensure compliance with Public Contracting Code and Policies and Procedures. We recommend districts formalize construction delivery methodology strategies and controls within their policies and procedures to establish appropriate approval controls and compliance with Public Contracting Code.

Common construction delivery methods include:

- Design-bid build. This method is where the district accepts competitive bids from contractors based on a completed project design. This methodology requires the district to contract with the lowest responsive and responsible bidder. Based on our experiences, this methodology has risk of higher change order costs absent strong change order audit rights, definition, and controls.

- Multiple prime. This is when design is split into multiple subcontractor packages and the district competitively bids each separately. Based on our experience, this requires higher district supervision and significant construction management experience, but when done effectively on less complex jobs, it can potentially reduce overall cost. When done ineffectively, it can result in significant budget overruns. Districts considering this methodology need to understand the risks and rewards associated with its use.

- Design build. This methodology engages both the designer and builder for preconstruction phases of major capital projects to ensure collaboration through construction completion. This delivery methodology can streamline communication among the project team and reduce project cost, change order exposure, and timelines. Complying with the various PCC requirements and using the right contract type is critical to compliance and cost containment.

- Lease-leaseback contracts. Refer to Davis v. Fresno Unified School District (April 27, 2023, S266344) for latest ruling and impacts to using this delivery methodology.

Contract Types

Choosing the right type of contract can be just as critical to managing budgets as competitive bidding procedures. Understanding the different types of contracts can help increase transparency and accountability.

The most common contract types are:

- Lump sum

- Time and materials

- Cost plus

- Construction Management at Risk (CMAR) or Guaranteed maximum price (GMP)

Each contract type should be evaluated for its suitability with common factors, including project size, schedule, and scope complexity. Lump-sum contract types, if not properly procured, can lead to higher markups, increased change orders or inadequate material quality.

Time-and-materials and cost-plus contract types that aren’t appropriately managed may encounter low productivity resulting in schedule delays and increased construction spending.

GMP contracts might suffer from poor cost-of-work definitions that result in a lack of control of budget and cost.

Strong GMP Cost-of-Work Definitions

Establishing strong cost-of-work definitions can have many benefits when coupled with a GMP contract. A GMP contract allows districts and contractors to define adequate allowable and unallowable costs of work for a project. Cost-of-work definitions, along with a right-to-audit clause, should be sufficiently clear to enable the efficient validation of compliant project charges.

Engaging an experienced team of construction auditors can help align best practices with competitive-bidding procedures, contract-type selection, and cost-of-work definitions.

Address Potential Red Flags and Report Publicly

Be vigilant for any potential red flags, such as unexpected cost increases, delays, or reporting inconsistencies. Investigate and address these issues promptly. An audit subcommittee that reports regularly to the CBOC can review supporting documentation and share findings and reports with the public to maintain transparency and accountability.

Be Curious and Constructive

Use the oversight process as an opportunity for continuous improvement. Where can processes be enhanced? Where can constructive recommendations be given to improve cost efficiencies and project effectiveness? Approaching review duties with optimism and an eye for opportunity can help bring more value to the bond monies and improve the program as a whole.

Looking Beyond Standard Performance Audits

All performance audits should comply with standards outlined under Prop 39. However, more expansive performance audits that examine spending efficiencies and effectiveness can bring significant benefits to school districts.

These expansive audits often result in significant control improvements and cost savings, which often exceed the audit’s fees.

Many school districts stop at the basic performance audit as it meets reporting requirements. CBOC members can help their school districts look beyond the basics and see how in-depth audits can uncover more cost-saving opportunities and help get more bang for the bond-generated buck.

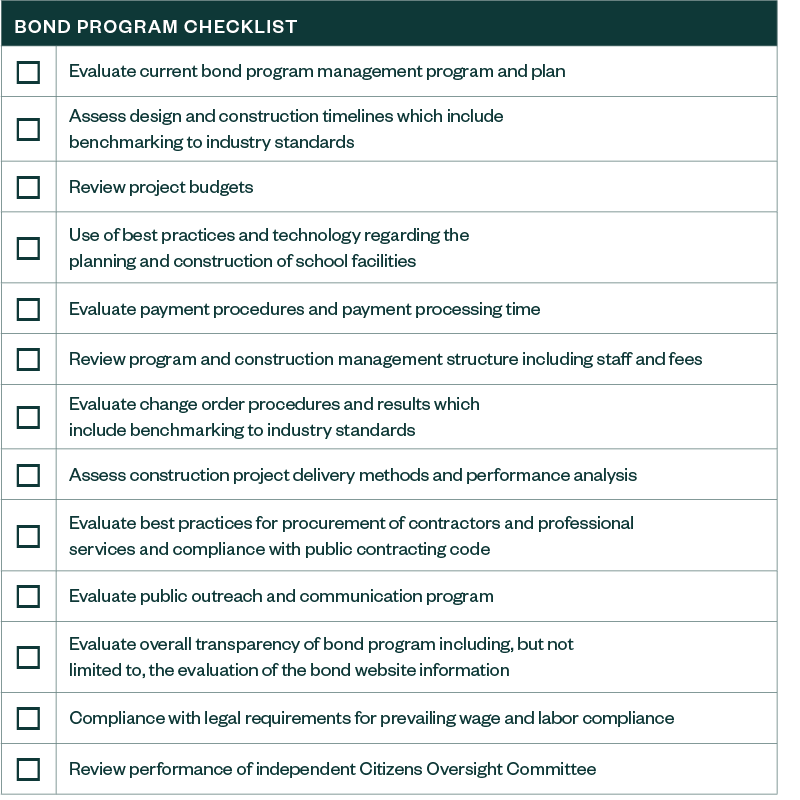

Next Steps: Checklist for CBOC and Performance Auditors

Simplify the oversight committee’s review process with the following checklist. These items align with best practices and cover everything an independent review and evaluation of a bond program should include.

We’re Here to Help

For more information on how to navigate expenditure reviews effectively, contact your Moss Adams professional.