2023 brought a mixed bag of opportunities and challenges for life sciences. While the scope for new disease discoveries and technology-based health care has widened, the ongoing geopolitical and financial instability have put a considerable degree of uncertainty in the market. The need to execute on feasible product pipelines and retain stable supply chains has become critical to securing investor confidence, while at the same time keeping up with changing regulations.

Going public can help life sciences companies secure the capital needed to grow thereby circumventing such volatility and insulating them from hindering their research and developmental goals. Despite the current dry spell, initial public offerings (IPO) are expected to regain momentum in 2024, and prospective applicants are urged to be prepared to make the most of this financing gateway.

For those initiating a registration statement for the first time, or making continuous public filings every year, adherence to SEC standards is key.

Understanding past SEC scrutiny encourages proactive preparedness, helping companies avoid similar comments and potentially saving time and money.

Meanwhile, for filers already in the public domain, revisiting SEC comments can help stay abreast of the dynamic regulatory landscape and compliance checks beforehand. This comes at a time when disclosures around climate change, cybersecurity, and cross-border risks are increasing steadily.

Our report, Under the Microscope: An Analysis of SEC Comment Letter Trends Among Middle-Market and Pre-IPO Life Sciences Companies, looks at SEC comments directed towards Forms S-1, 10-K, 10-Q, and 20-F filings made by life sciences companies during the review period from May 1, 2022, to April 30, 2023 (“2022 to 2023”). Comments were analyzed by frequency to identify the most prominent topics under SEC scrutiny.

Below, we cover key findings in the 2022–2023 SEC report, comparisons to findings from prior years, and implications for middle-market and pre-IPO life sciences companies.

Initial Findings

As in previous years, R&D continued as the largest area of SEC focus in 2022-2023, with a strong emphasis on disclosures surrounding companies’ clinical trials and in-process product development.

Focus on process compliance and entity-related disclosures remained steadfast, especially in the context of cross-border operations. At the same time, scrutiny around resale offerings saw a sudden uptick in comments.

Comment Categories

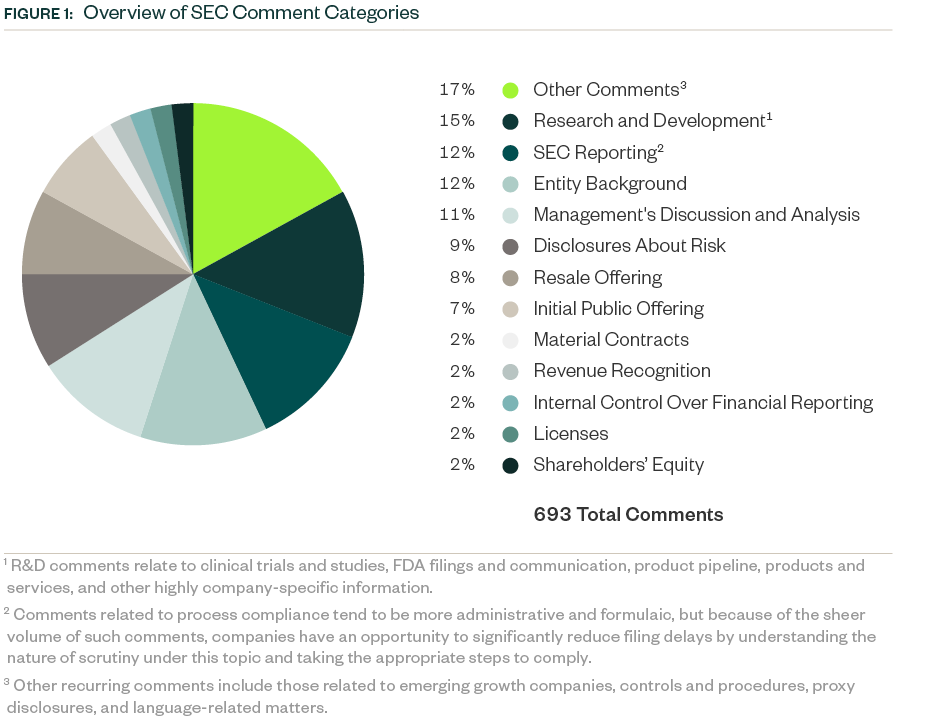

The SEC had 693 comments related to Forms S-1, 10-K, 10-Q, and 20-F during 2022-2023.

Some key categories comprised the bulk of the comments, and those related to R&D represented a 15% share. As in previous years, the SEC focused on ensuring complete disclosure of clinical trials and studies, as well as requiring clarity and objectivity in developmental products and pipelines.

SEC reporting, or process compliance, was the next major comment category with a share of 12%. As in the 2021–2022 period, this category had the most comments requiring companies to make requisite disclosures throughout their prospectus, including filing all material information.

This was followed by comments requiring disclosure of the following:

- Entity background

- Management’s discussion and analysis (MD&A)

- Current and anticipated risks related to the business

- Details on the actual offering and use of proceeds

Information around material contracts, revenue recognition, internal control over financial reporting, licensing agreements and shareholders’ equity collectively constituted another significant chunk of SEC scrutiny, followed by various other comments targeting company-specific controls and regulatory features.

The following infographic depicts a breakdown of the total 693 comments analyzed, according to category and frequency.

Significant Shifts

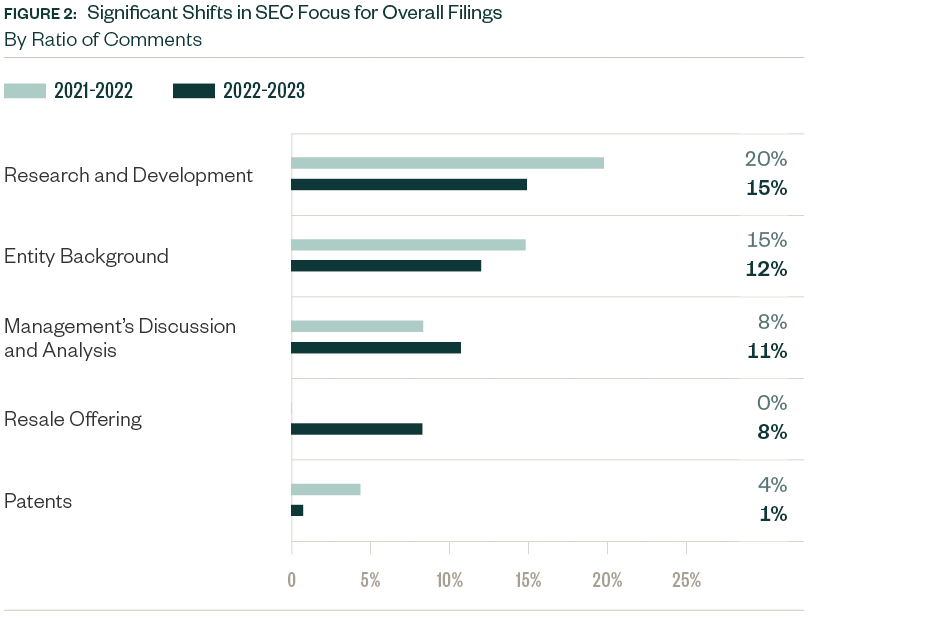

Numerous topics saw shifts in focus from slight to significant compared to 2021–2022, with the positive or negative variance measured as a ratio to the total number of comments.

This included categories such as:

- R&D

- Entity background

- MD&A

- Resale offering

- Patents

Comments related to MD&A increased by 3% while those related to resale offerings—not covered in the previous period’s study—made up 7.8% of the mix this period. Comments directed toward R&D decreased by 5.1%, while those related to entity background and patents slightly decreased by 2.9% and 2.7%, respectively.

The mean variance of overall comments doubled from 1.3% in 2021–2022 to 2.6% this period, related to the sharp decline in total number of comments and shift in categorization spread. Requests for disclosures in new areas, such as resale offerings, emerged, while those related to typical and conventional topics were less prominent.

Filing Type

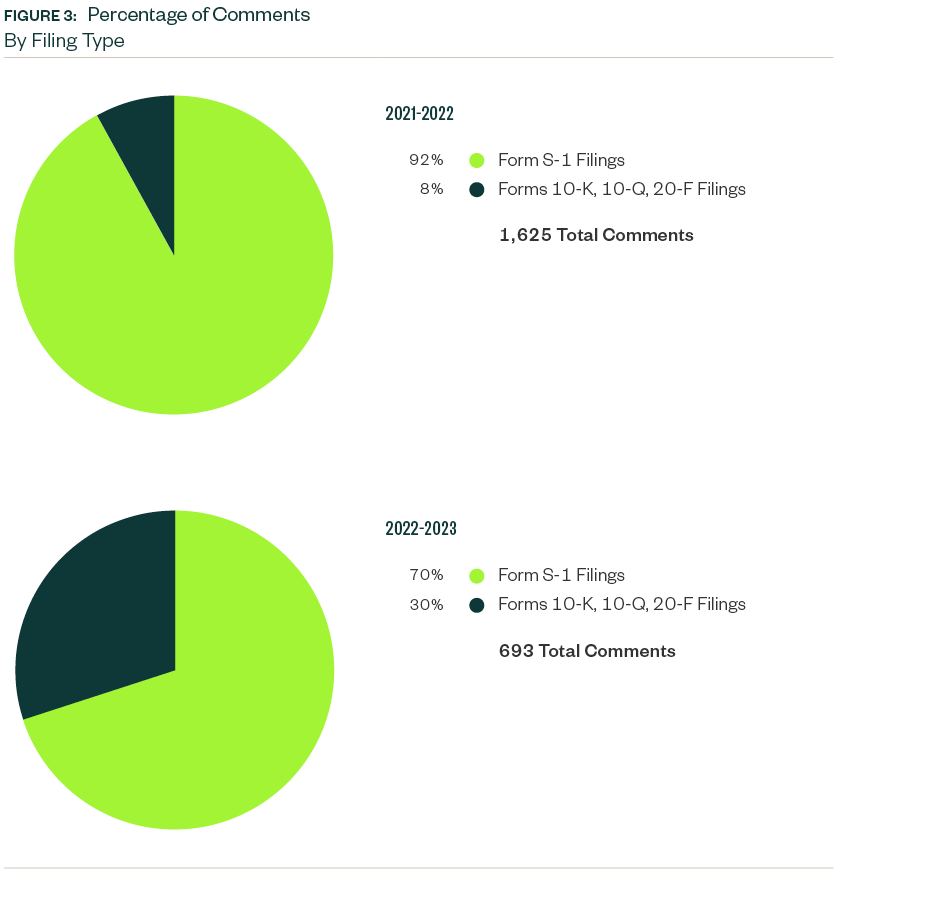

Like prior years, Form S-1 filings continued to lead in relation to SEC scrutiny, however the relative share fell considerably from the last period. Of the 693 total comments analyzed in the study, roughly 70%—or 487 comments—were directed at Form S-1 filings. This is a slight decrease from a share of 92% in 2021–2022.

The remaining 30% of comments were directed toward Forms 10-K, 10-Q, and 20-F filings.

Like the 2021–2022 study, the nature of comment categorization varied among filing types.

Form S-1 comments related to more contextual and background information, such as details on R&D, process compliance, entity background, IPOs, and risk-based disclosures. Pre-IPO applicants were asked to elaborate on product pipeline, solution breakthroughs, potential market standing and anticipatory risks, and clarify details of offering terms and price.

Meanwhile, comments related to resale registrations also came into focus this period and relevant Form S-1 filers were asked to provide more details on such offerings, including what potential impact there could be on stock value.

For all public filers, MD&A remained the focus, like last period, with the SEC requiring many companies to be clear and consistent with disclosure of operational results year-over-year.

Comments that centered on entity background and process compliance were more technical, such as ones requesting disclosure of a company’s legal structure and material interests or requiring filing of all necessary certifications.

Market Capitalization Range

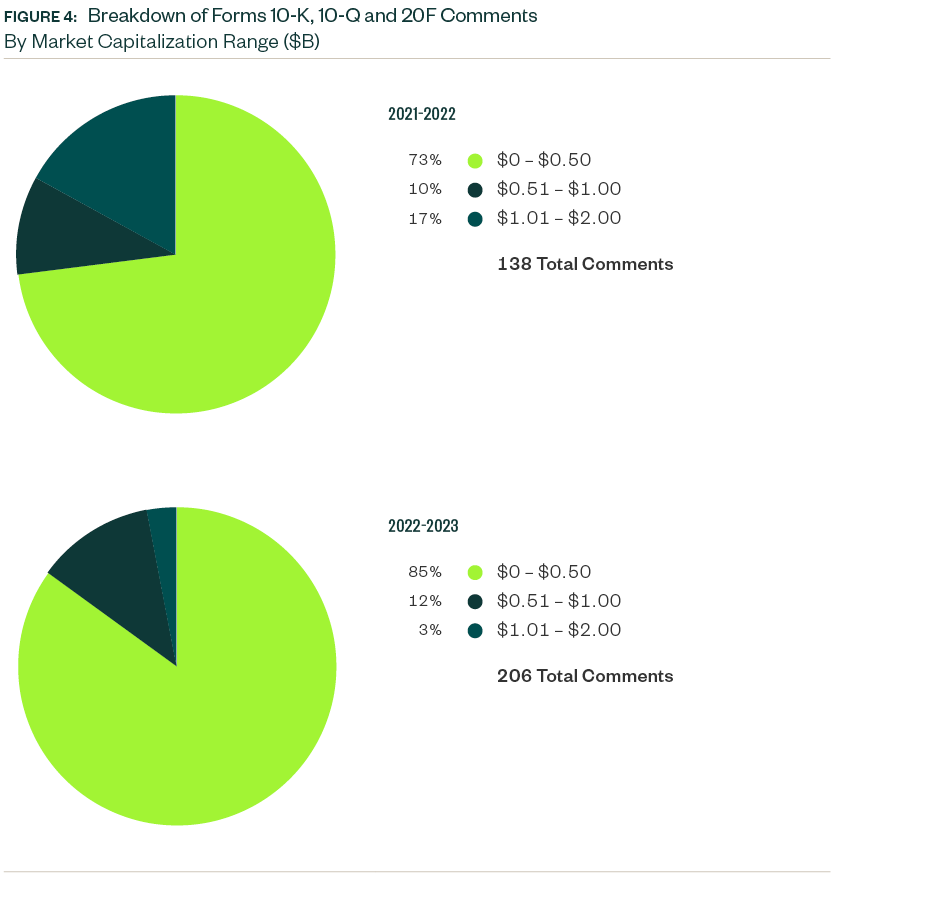

Over 85% of Forms 10-K, 10-Q, and 20-F comments centered on companies with a market capitalization of less than $500 million. Of the remaining, 12% were directed toward those with market capitalization between $500 million and $1 billion while 3% pertained to those greater than $1 billion but less than $2 billion.

Smaller companies continued to attract the greatest scrutiny.

Results by Subindustry

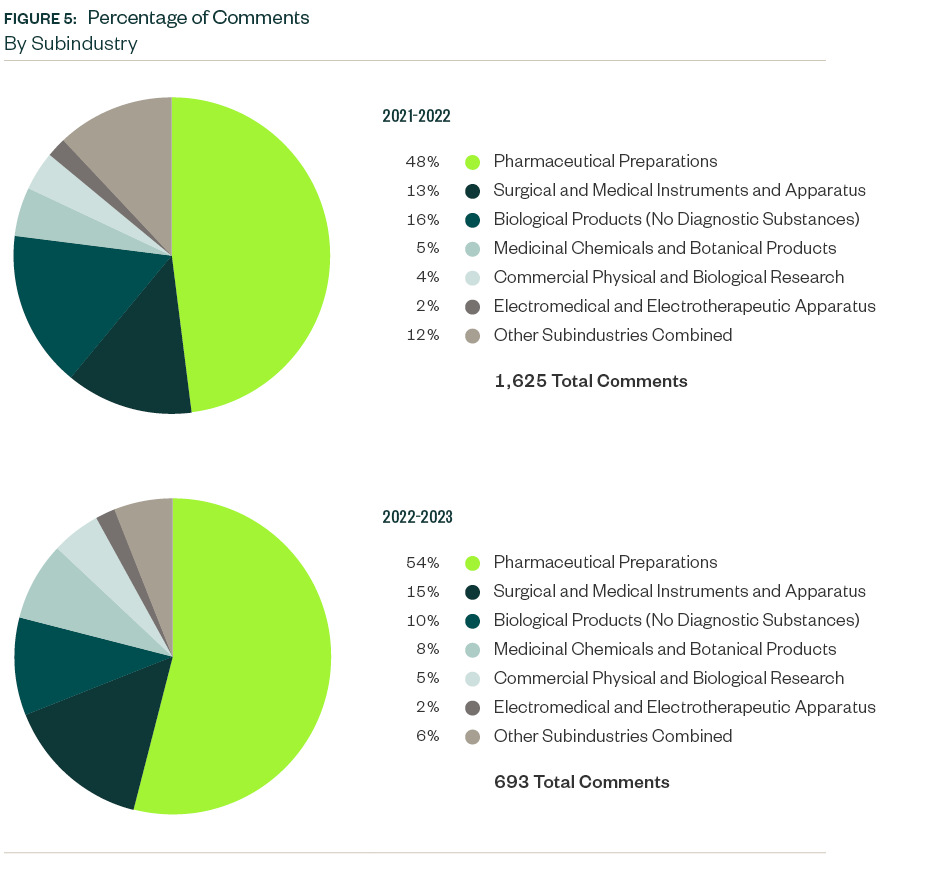

The SEC focused on the pharmaceutical preparations subindustry more than most analyzed in this study. Total SEC comments on that subindustry increased from a 48% share in 2021–2022 to a 54% share this period.

Surgical and medical instruments and apparatus stood as the next most significant subindustry with an aggregate share of 15%, followed by biological products at 10%.

While the ratio of comments for surgical and medical instruments and apparatus went up by 2% from the previous study, biological products comments dropped 6%. The increase and decrease pattern between these subindustries persisted for four consecutive twelve-month periods.

Medicinal chemicals and botanical products was the fourth largest subindustry with a comment share of 8%. SEC focus here considerably increased from the previous report.

Commercial physical and biological research, which also saw a slight rise from the previous study, accounted for a 5% share in this period.

A mix of various other subindustries followed with shares of less than 3% each.

X-ray apparatuses and tubes and related irradiation apparatus, which didn’t attract any relevant comments in 2021–2022, accounted for 16 comments this period.

Additional Content

The SEC considers both the macro environment and business-specific value chains when directing the nature of review. While topics like process compliance were generically commonplace for the entire life sciences sector, others varied among subindustries.

For example, scrutiny over R&D remained more significant for pharmaceutical preparations and biological products, while entity-related disclosures were a focus for medicinal chemicals and botanical products.

This period also saw an influx of comments related to resale offerings, which were highly concentrated in subindustries such as surgical and medical instruments and apparatuses, biological products, and commercial physical and biological research.

This doesn’t mean, however, that the nature of comments within a subindustry remains static. Certain topics may attract greater scrutiny in certain years. This depends on market dynamics at the time of the SEC’s analysis, which may bring certain issues to the forefront, and the efforts companies undertake to properly address those areas in their statements.

We’re Here to Help

For more information on SEC comments, read our full guide or contact your Moss Adams professional.