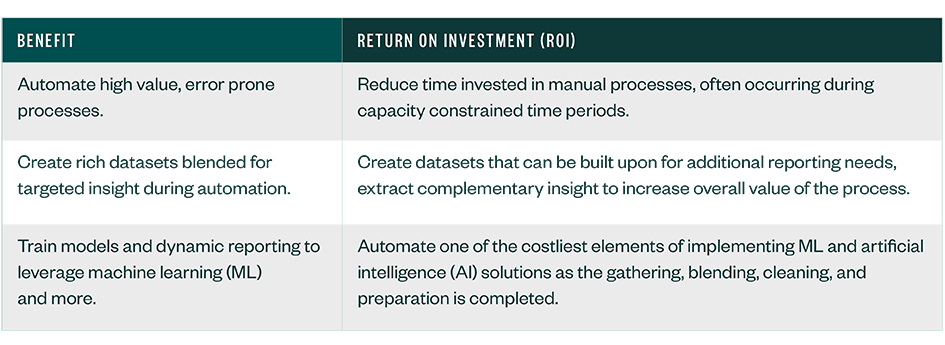

Organizations, particularly those dealing with complex tax analysis and preparation processes, can greatly benefit from using analytic process automation (APA).

APA, along with intelligent automation processes, can help automate and streamline various processes, such as data aggregation, data validation, tax liability forecasting, and compliance reporting.

Organizations can then focus more on strategic planning and less on manual, time-consuming tasks. The use of APA in tax processes represents a significant step forward in the digital transformation journey of tax departments, enabling them to deliver greater value and impact.

What Is Analytic Process Automation (APA)?

APA tools, such as Alteryx and Tableau Prep, function by automating data preparation and compilation from multiple source systems and sharing the data via a data analytics platform throughout an organization.

How to Leverage Analytic Process Automation

Four ways that APA can be applied to support your business’s tax needs include:

- Automated data aggregation

- Tax data collection and validation

- Tax liability forecasting

- Compliance reporting

Automated Data Aggregation

APA can be used to automatically gather and consolidate tax-related data, including:

- Payroll

- Property

- Sales

- Income

A spreadsheet approach can become complex and time-consuming with the amount of data needed for these tax process. APA simplifies the process and can easily handle large volumes of information. This can significantly reduce time spent on data collection and preparation for tax reporting.

Tax Data Collection and Validation

Tax data is often stored across multiple systems as well as spreadsheets. APA can be an efficient way to automate tax-data collection, consolidation, and validation—and with less errors.

Tax Liability Forecasting

APA can streamline the forecasting process by utilizing historical tax data to predict future tax liabilities for different tax categories to aid planning.

Compliance Reporting

APA can create compliance reports that detail how tax procedures and policies are being followed. These reports can be used for internal audits or provided to regulatory bodies to demonstrate compliance with tax laws and regulations.

We’re Here to Help

For guidance on analytic process automation and intelligent automation considerations for your organization, contact your Moss Adams professional.