Businesses with certain hiring and wage-based programs could earn tax credits, cash incentives, training reimbursements, and other benefits for their existing practices through federal and state-level programs that aim to encourage job creation and investments in the workforce.

To claim credits and incentives, however, businesses must meet certain eligibility requirements.

Explore opportunities, including credit amounts and qualifications, to determine if your business might be able to leverage these advantages.

Federal Hiring and Wage-Based Incentives

- Work Opportunity Tax Credit (WOTC)

- Empowerment Zones

- Disaster Retention Credits

Work Opportunity Tax Credit

The WOTC is a wage-based credit available to employers who hire individuals who may face barriers to employment and qualify under a specified target group. The credit works by offsetting your federal income tax liability.

Here’s an overview of the program.

- Application. Program requires filing applications for new hires with state agencies within 28 days of the hire date.

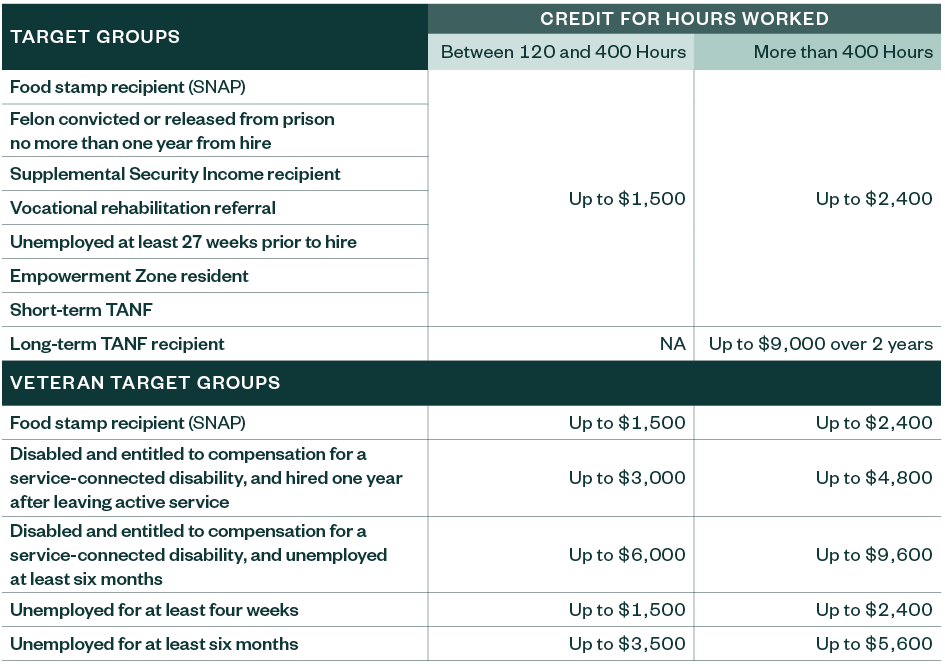

- Credit amount. The value of the tax credit is determined by the number of hours worked and wages earned within first 12 months of employment or 24 months for Long-term Temporary Assistance for Needy Families (TANF).

- Terms. Nontransferable and nonrefundable federal income tax credit that allows a one-year carryback or 20-year carryforward.

- Duration. Active through December 31, 2025—legislation extended as part of the Consolidated Appropriations Act.

- Qualified hires. One-time credit per qualified new hire—rehired or repeat seasonal employees are ineligible.

Credit Amounts for Target Groups and Hours Worked

Employer Versus WOTC Provider Responsibilities

Outsourcing the administrative burden to a WOTC advisor can help streamline processes and provide time and resource support.

WOTC advisor support can include a variety of responsibilities:

- Provide a screening tool to employers

- Track and monitor receipt of timely forms

- Process all qualified employee forms and file with state WOTC coordinators

- Manage backlogs with applicable states to speed up the certification process

- Perform denial appeals when appropriate under the Freedom of Information Act (FOIA)

- Obtain all certifications from the states

- Calculate the eligible credit for easy reporting on the federal return

The employer’s responsibility is to provide access and ensure all eligible individuals complete the screening on time and provide payroll on a scheduled basis.

Empowerment Zone Credits, IRC Section 1396

Empowerment zone credits are income tax credits for employers who have physical locations in federal empowerment zones and hire individuals who live and work in the zone.

- Requirements. Minimum 90-day retention

- Duration. Legislation is active through 2025 and extensions are typically included in a package with WOTC.

- Credit amount. The credit is 20% of qualified wages up to $15,000, with a max credit of $3,000 per employee per year the employee lives and works in the zone.

- Terms. Nontransferable and nonrefundable federal income tax credit that allows one-year carryback or 20-year carryforward.

Disaster Retention Credits

Disaster retention credits are income tax credits for employers who have one or multiple locations within a federally declared disaster zone that became inoperable as a result of damage sustained from a natural disaster.

- Eligibility. Wages for employees whose principal place of employment was impacted and the company retained and continued to pay.

- Duration. Eligible period begins the day the location was impacted until the business resumes significant operations or 150 days after the disaster incident period.

- Credit amount. The credit is equal to 40% of eligible wages up to $6,000 of wages resulting in a maximum $2,400 credit.

- Terms. Nontransferable and nonrefundable federal income tax credit that allows one-year carryback or 20-year carryforward.

State Hiring and Wage-Based Incentives

The following are hiring and wage-based incentives available on the state level.

Hiring and Wage-Based Credits

Details and Qualifications

- Job creation. These incentives typically require a net new increase in headcount from a defined base year. Generally, in-state transfers aren’t allowed and there’s a defined period to create jobs.

- Job retention. Companies can receive incentives for retaining jobs at a facility or office. The number of retained jobs is typically calculated using the prior 12-month period as a baseline. Companies usually must retain these jobs for a defined period of time.

- Wage thresholds. These may vary across jurisdictions. They can be a state or county median wage or a multiple of a low-income wage threshold, and companies paying higher than average wages may receive an increased credit amount per new job.

- Jobs. It’s important to understand the program’s definition of full-time job. Some programs allow part-time jobs to be added together to equal a full-time equivalent.

Following are details of tax credit programs available in California, Colorado, New Mexico, and Tennessee.

California Competes Tax Credit

- A discretionary, nonrefundable income tax credit with a six-year carryover

- Credit awards are tied to job creation

- Three competitive application rounds each fiscal year

- Creating at least 25 jobs over five years

- Average wage should be over $80,000

Colorado Job Growth Incentive Tax Credit

- A nonrefundable income tax credit with a 10-year carryover

- Credit equal to 50% of the FICA tax paid per net new job, per year for up to eight years

- Rolling competitive application rounds

New Mexico High Wage Job Tax Credit

- A refundable tax credit applied to state gross receipts, compensating, and withholding taxes

- Credit capped at $12,750 per job, per year for up to four years

- No minimum job creation, but need to demonstrate continually increasing headcount

- Minimum salary of $60,000; $40,000 in rural areas

Tennessee Job Tax Credit

- A nonrefundable tax credit applied to franchise and excise taxes may be carried forward up to 25 years

- Standard credit $4,500 per job; enhancement credits available

- Must create at least 10 net new jobs depending on county

- Must invest at least $500,000 over a three-year period

Workforce Development

Following is information on services offered, qualifications, and available opportunities in Georgia, Oregon, Washington, and Texas.

Workforce Services Offered

Workforce development programs can offer help in the following areas:

- Partnerships

- Recruitment assistance

- Applicant screening

- Training reimbursement

- Customized training

- Grants

Workforce Qualifiers

The following are qualifications for workforce development programs:

- Hire new employees

- Offer on-the-job training

- Retrain employees

- Provide certification renewals

- Offer internships or apprenticeships

- Offer internal or external trainers

Workforce Development Agencies

The following are workforce development opportunities:

- Georgia QuickStart

- Oregon Workforce & Talent Board

- Washington Local Workforce Development Boards

- Texas Workforce Commission

Competitive Grants

Grant programs target both job creation and investment.

Job creation grant programs typically:

- Require a large number of net new jobs

- Don’t allow in-state transfers

- Have a defined period to create jobs; usually require a competing location

Investment grant programs typically:

- Require significant capital investment

- Involve infrastructure, real property, and personal property capital investments

- Can require approval from governor’s office

Following are details on qualifications and available grant programs.

Typical Grant Program Qualifications

- Targeted industries

- High-paying skilled jobs

- Three to five year project period

- Considering other out-of-state alternative locations and have not yet decided on a project location

Popular Competitive Grant Programs

- Texas Enterprise Fund

- One North Carolina Fund

- California Competes Grant Program

- New Mexico Local Economic Development Act

We’re Here to Help

For guidance on qualifying for and filing federal and state credits and incentives, contact your Moss Adams professional.