Forecasting your private company’s finances is one of the most important parts of preparing for the next fiscal year and setting your business up for success. When combined with a top-notch accounting department, a financial forecast can be one of the most effective cash-management tools available.

Forecasting your private company’s finances is one of the most important parts of preparing for the next fiscal year and setting your business up for success. When combined with a top-notch accounting department, a financial forecast can be one of the most effective cash-management tools available.

However, finding the time to create your financial forecast can be challenging, and there are many different approaches depending on your company’s life-cycle stage, industry, or even end user.

As you prepare for the coming forecast period, these six tips and strategies might be useful.

1. Forecast Scenarios

Predicting your company’s future can be particularly challenging, especially if your company is a startup or is growing significantly. Creating multiple forecast scenarios can help you understand how your company could be impacted by different potential outcomes.

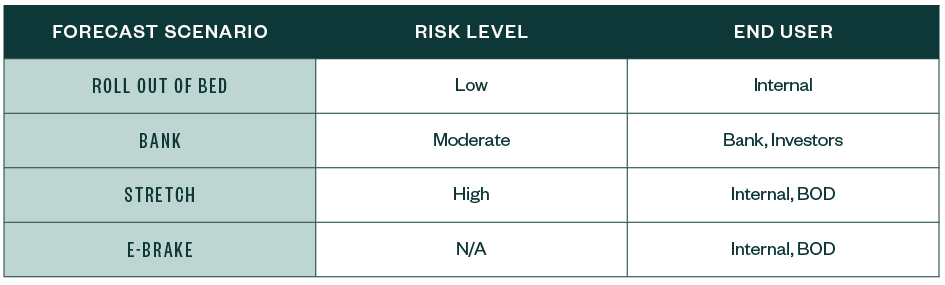

The following four forecast scenarios, which we’ll discuss in detail below, could be helpful for your private company.

Each forecast scenario varies in terms of risk—such as the ability to hit projected revenue and profitability—and each is suited for a particular end user, such as a bank, investor, the board of directors (BOD), or internal business unit.

Scenario 1: Roll Out of Bed

The roll-out-of-bed (ROB) financial forecast scenario has the least risk in terms of your company’s potential to achieve the predicted revenue and profitability. This is the forecast your employees could literally roll out of bed and achieve. In other words, your company should be very comfortable with its ability to hit the projected revenue and expense numbers.

The ROB forecast is especially useful because it shows, from a revenue and cash standpoint, a company’s standing if it were to exert minimal effort or take minimal risks.

Scenario 2: Bank

The bank financial forecast scenario is the forecast your company can give to a bank or investor. Banks will often require your company to provide an annual financial forecast that has been approved by the BOD. This forecast is one risk level higher than the ROB forecast because it has more aggressive revenue growth—and possibly profitability—expectations.

Before submitting a forecast to the bank, your company should be confident in its ability to not only hit the forecast, but also beat it. Providing the bank with a rock-solid forecast scenario helps instill confidence in your business, and including growth as part of your plan keeps the bank interested and impressed.

Scenario 3: Stretch

The stretch forecast scenario represents your company’s ideal financial year. Of the forecast scenarios, this approach has the most risk because it has the most aggressive revenue growth and profitability expectations of all previously discussed scenarios.

This is the forecast on which your employees should set their sights, and with which their performance-based compensation should be aligned. If your company is able to meet or exceed the stretch forecast by the end of the period, it should also be able to achieve all of the previously discussed forecast scenarios, resulting in satisfied bankers, investors, and employees.

Scenario 4: E-Brake

The e-brake financial forecast scenario can be put into action if your company comes across a major financial or business problem and needs to extend its cash runway to fix it. Businesses extend their cash runways by slowing down hiring or even downsizing.

While no one likes to talk about this scenario, failures are common in a business environment—especially if your company is a startup—so it’s important to be prepared for potential setbacks and know ahead of time how they could impact your company.

2. Cash Versus Accrual

If your company is primarily concerned with cash management, you’ll likely need to operate within a cash-based forecast. Cash-based forecasts can help private companies answer key questions about their finances, such as:

- How much cash will the business generate or expend this period?

- How many months of cash runway do we have?

- When do we need to infuse the business with extra capital to continue operations?

Accrual-based forecasts, on the other hand, aren't particularly useful for private companies because accrual net income can be very different from cash net income. This is especially true if your business is collecting large amounts of cash from customers up front, or if you have significant prepaid expenses. For these reasons, it may not be worth your company’s time to create an accrual-based forecast.

However, if you decide an accrual-based forecast is the most appropriate type of forecast for your business, make sure to also prepare an accompanying balance sheet and cash-flow statement so you can closely monitor your account.

3. Keep It Simple

It's easy to overcomplicate a financial model with advanced Excel engineering, but having more inputs, macros, and formulas doesn’t always lead to greater accuracy.

Being able to make changes on the fly is something you want to keep in mind as you create your financial model. Your model should be simple enough that you can easily input new assumptions if you need to quickly test the impact of certain changes.

4. Quality Control

A second reviewer should look over your financial model to make sure the math, assumptions, and formulas check out. The reviewer could be a teammate or a third party, depending on the size of your accounting or finance team. A quality peer or third-party review can help reveal errors that could undermine your model.

5. Involve the Right People

When building your financial forecast, getting the highest quality information from the right people is more important than creating your model quickly. While involving the right people and getting the best available information may take time, it can make your forecast stronger and more accurate.

During this process, make sure to include department leaders; you may have a hard time getting your forecast approved if leadership isn’t involved in the creation process.

6. Incentive Stock Option Valuations

If you’re providing a forecast to a third-party valuation specialist for purposes of valuing your employee-incentive stock options (ISO), it’s important to give the appraiser the most appropriate forecast. Providing the stretch forecast, for example, may lead to a significant overvaluation of the ISO to the detriment of your employees. If your company doesn’t hit a previously provided forecast, it could negatively impact future valuations.

Instead, providing the ROB or bank forecast may lead to better results for your employees and may lessen the chances of your ISO share price decreasing in the future. Experienced appraisers will always compare forecasts for updates to prior valuations, so be consistent in whichever approach you choose.

We’re Here to Help

Forecasting your company’s future is a multistep process that can be simplified by taking a comprehensive approach. To learn more about forecasting strategies or to begin the process, contact your Moss Adams professional.