There are a number of financial relief efforts for the health care sector due to COVID-19 disruption. Details about grants and funding opportunities as well as important considerations for health care entities are below.

Congress approved funding packages that have been and will continue to be awarded to federal agencies, including the Federal Emergency Management Agency (FEMA), the Centers for Disease Control and Prevention (CDC), and the US Department of Health & Human Services (HHS).

Large sums have been designated for health care industry purposes. The federal agencies will award the funds directly to health care providers as well as to states or state agencies, which will then pass the funds to hospitals and provider recipients.

For information about how to report COVID-19 funding on the Medicare Cost Report, including the Provider Relief Fund (PRF), Unreimbursed Program payments, Small Business Association (SBA) loans, and deferred Social Security taxes, reference pages 107–110 of the CMS FAQs on Fee-for-Service Billing.

Provider Relief Fund

The PRF authorized $178 billion for hospitals and providers through the Coronavirus Aid, Relief, and Economic Security (CARES) Act (HR 748), which includes an additional $75 billion interim fund signed on April 24, 2020 (Paycheck Protection Program and Health Care Enhancement Act), as well as $3 billion added by the Consolidated Appropriations Act, 2021, on December 27, 2020.

Recipients must attest to each payment received within 90 days of receipt, which was extended from the original 30 days, and agree to the Terms & Conditions, otherwise remit the payment back to HHS. HHS has explicitly stated that the funds are taxable income.

Reporting Requirements

UPDATED: On January 15, 2021, HHS released the General and Targeted Distribution Post-Payment Notice of Reporting Requirements for the PRF, a major update and overhaul regarding the determination of eligible expenses and lost revenue. This update modifies an October 22, 2020, update of guidance originally released September 19, 2020.

The January update reflects changes that were finalized in the Consolidated Appropriations Act, 2021. Namely, it reverts the definition of lost revenue to prior guidance in June 2020 FAQs. Recipients are allowed to choose one of three methodologies to calculate lost revenue and transfer targeted distributions among related entities.

Timing

UPDATED: HRSA’s PRF reporting portal opened for registration on January 15, 2021. There’s currently no published deadline to register for the portal or submit reporting data.

The reporting periods remain consistent with prior guidance—the first reporting period is calendar-year 2020. If funds haven’t been fully expended by December 31, 2020, recipients can file a final report for expenses and lost revenue incurred January 1, 2021 – June 30, 2021.

Audit Requirement

PRF General and Targeted Distribution payments and Uninsured Testing and Treatment reimbursement payments must be included in determining if a Single Audit in accordance with 45 CFR Subpart F is required (if annual total awards expended are $750,000 or more in the organization’s fiscal year).

For-profit entities have the option to either perform a financial audit conducted in accordance with Generally Accepted Government Auditing Standards (45 CFR 75.216) or the Single Audit.

Distribution

$30 Billion General Distribution (Phase 1, First Tranche)

On April 10, 2020, and April 17, 2020, HHS distributed $30 billion directly to hospitals and eligible providers, based on Medicare fee-for-service (FFS) historic billing.

$20 Billion General Distribution (Phase 1, Second Tranche)

Beginning on April 24, 2020, $20 billion was distributed to hospitals and providers, based on 2018 net patient revenue from all payer sources and estimated losses for March and April 2020, which were to be reported via the General Distribution portal by June 3, 2020.

Entities that submit CMS cost report data automatically received a payment; however, they were required to confirm the data via the portal. Similar to the first tranche, recipients must attest, prior to reporting the data above, and agree to the Terms & Conditions. Adjustment payments were distributed on a weekly basis; the first batch was distributed May 15, 2020.

Second Chance to Apply (Phase 2)

HHS announced it would reopen the reporting portal to Medicare providers that experienced challenges with the General Distribution second tranche application. The portal to submit financial data was available until September 13, 2020.

Third Chance to Apply (Phase 3)

UPDATED: On October 1, 2020, HHS announced that it will distribute $20 billion in Phase 3 of the General Distribution. The application portal closed on November 27, 2020. When awards were announced, HHS allocated additional funds to Phase 3, bringing the total distribution to $24.5 billion.

Eligible providers include:

- Providers that previously received, rejected, or accepted a General Distribution PRF payment. Providers that have already received payments of approximately 2% of annual revenue from patient care may submit more information to become eligible for an additional payment.

- Behavioral Health providers, including those that previously received funding and new providers.

- Healthcare providers that began practicing January 1, 2020–March 31, 2020. This includes Medicare, Medicaid, Children’s Health Insurance Programs (CHIP), dentists, assisted-living facilities, and behavioral health providers.

Phase 3 payments were distributed in various waves, beginning December 16, 2020, and continuing through early 2021.

$12 Billion High Impact Allocation

This was for hospitals located in so-called COVID-19 hot spots. Funds were distributed to 395 hospitals that provided inpatient care for 100 or more COVID-19 patients through April 10, 2020, mostly located in New York.

$10 Billion for Second Round of High-Impact Payments

On June 8, 2020, HHS sent a request to hospitals to update information on their COVID-19 inpatient admissions for the January 1, 2020–June 10, 2020 period to determine a second round of funding. Payments of $50,000 per eligible admission were distributed to hospitals with 161 or more admissions, beginning the week of July 20, 2020. The TeleTracking portal is open for reporting ongoing updates, which may determine future distributions.

$10 Billion for Rural Providers

Funds were distributed to critical access hospitals (CAHs), rural health clinics (RHCs), and rural federally qualified health centers (FQHCs) on May 6, 2020, with a base payment of $1 million per CAH and $100,000 per clinic. Funds were adjusted based on operating expenses.

A subset of RHCs didn’t receive payments on the first distribution, in error. To correct this, on June 25, 2020, HHS distributed a payment of approximately $103,000 to each of these RHCs.

On July 10, 2020, HHS announced that it would expand its payment formula to include certain special rural Medicare-designation hospitals in urban areas as well as others that provide care in smaller, nonrural communities. These could include some suburban hospitals that aren’t considered rural but serve rural populations and operate with smaller profit margins and limited resources than larger hospitals.

HHS estimates the expanded funding would provide relief of over $1 billion to 500 recipients with payments ranging from $100,000 to $4.5 million for rural-designated providers and $100,000 to $2 million for suburban providers.

$225 Million for RHC Testing

On May 20, 2020, $49,461 per RHC was distributed for COVID-19 testing and related expenses. This payment won’t be included in the PRF reporting process, described above.

$4.9 Billion for Skilled Nursing Facilities (SNFs)

On May 22, 2020, SNFs received a base payment of $50,000, plus $2,500 per bed.

$500 Million for Indian Health Service (IHS) Providers

This was distributed based on operating expenses.

$15 Billion General Distribution (Phase 2) to Medicaid, CHIP, Dental & Assisted Living Facility (ALF) Providers

This was for providers that participate in state Medicaid and CHIP, dentists, and private-pay assisted living facilities that haven’t previously received a payment from the PRF.

HHS estimated nearly 1 million health care providers may have been eligible for this funding, including but not limited to pediatricians, obstetrician-gynecologists, opioid treatment and behavioral health providers, assisted-living facilities, and other home and community-based services providers. Payments were at least 2% of annual patient revenue; provider reports were due through an enhanced portal by September 13, 2020.

On July 10, 2020, HHS announced that this portal was available to dentists who may not have previously been eligible to receive funding through the PRF.

$10 Billion to Safety-Net Hospitals

This was for those safety-net hospitals that serve a disproportionate number of Medicaid patients or provide large amounts of uncompensated care. To qualify, hospitals must have average uncompensated care per bed of at least $25,000; profitability of 3% or less, as reported in the most recent CMS cost report; and a Medicare Disproportionate Payment Percentage of 20.2% or greater. The payments were distributed on June 12, 2020, and each hospital received $5 million–$50 million.

On July 10, 2020, HHS announced that it would expand its criterion. Certain acute care hospitals became eligible for payment if they met the revised profitability threshold of less than 3% averaged consecutively over two or more of the past five cost reporting periods. HHS expected to distribute over $3 billion across 215 acute care facilities, bringing the total payments for safety net hospitals to $12.8 billion across 959 facilities.

$2.5 Billion for Nursing Home Infection Control

This was to build nursing home enhanced infection-control skills and to address critical needs such as testing, staffing and PPE. On August 27, 2020, HHS distributed $2.5 billion to CMS-certified SNFs and nursing homes with six or more beds, specifically for infection-control expenses. Recipients were paid $10,000 per facility, plus a per-bed payment of $1,450.

HHS previously stated that an additional allocation will be distributed based on performance outcomes in the coming months. A previous CMS announcement stated that to qualify for funding, nursing homes are required to complete a training program. On August 25, 2020, CMS provided details on how to register for this CDC training.

$2 Billion Performance-based Payment to Nursing Homes

On September 3, 2020, HHS announced nursing homes won’t have to apply to receive a payment; instead, HHS will measure nursing home performance through required data submissions and distribute payments based on this data. Payments of $400 million will be distributed in five performance periods in September, October, November, December, and aggregate.

To qualify, a facility must have an active state certification as a nursing home or SNF, receive reimbursement from CMS, and have active Provider, Enrollment, Chain, and Ownership System (PECOS)-enrollment. Facilities must also report to at least one of three data sources: Certification and Survey Provider Enhanced Reports (CASPER), Nursing Home Compare (NHC), and Provider of Services (POS).

Nursing homes will be assessed based on a full month of data submissions, which will then undergo additional HHS scrutiny and audit before payments are issued the following month. The final performance period will look at aggregate performance across the prior four months. Using data from the CDC, HHS will measure nursing homes against a baseline level of infection in the community where a given facility is located.

These distributions will be subject to the same terms and conditions as the Nursing Home Infection Control Distribution that was distributed August 27, 2020. Note there are limitations on eligible expenses.

Awards were distributed November 2 and 30, 2020; December 9, 2020; and January 25, 2021.

$1.4 Billion to Children’s Hospitals

On August 21, 2020, eligible hospitals received 2.5% of their net revenue from patient care. To qualify, a free-standing children’s hospital must have either been an exempt hospital under the CMS inpatient prospective payment system or a Health Resources and Services Administration (HRSA)-defined Children’s Hospital Graduate Medical Education facility, per HHS.

HRSA and Other Federal Agencies

Significant payments have also been distributed to health care providers through the HRSA’s existing infrastructure. Additional distributions have been distributed to quality improvement organizations and regional- or state-based networks, that aren’t listed below. The complete list can be accessed on the HRSA website.

Distributions

Unspecified Amount of Funds for Testing and Treatment for Uninsured COVID-19 Patients

This applies to services provided on or after February 4, 2020. The claims can be reimbursed at Medicare rates, subject to availability.

Registration opened April 27, 2020, and claims could be submitted beginning May 6, 2020, with payments distributed on an ongoing basis. While this is technically part of the PRF, the payments are distributed by HRSA, and aren’t included in the PRF reporting process described above.

Nearly $2 Billion to 1,400 Community Health Centers

The total awards were in three payments totaling $100 million, $1.3 billion, and $583 million, with the latter award being specifically for COVID-19 testing.

$117 Million for Health Center Quality Improvement

On August 25, 2020, the HRSA distributed awards for various achievements, such as improving cost-efficiency or quality, to 1,318 health centers nationwide. This award isn’t related to CARES Act funding.

$955 Million for States and Tribes to Support Seniors

This was distributed by the Administration for Community Living (ACL) for home and community-based services, nutrition, caregiver support services, and the long-term care ombudsman program. See allocation by state and program.

State Hospital Association Grants

Amounts and funding purpose vary by association.

SNF Distribution of COVID-19 Diagnostic Testing Equipment

On July 14, 2020, HHS announced distribution of a point-of-care antigen testing instrument and approximately 400 tests to SNFs in high-impact areas or those that have three or more cases.

NEW: An additional $250 million for the FCC COVID-19 Telehealth Program

Stay tuned. Details are forthcoming regarding the program eligibility and application process.

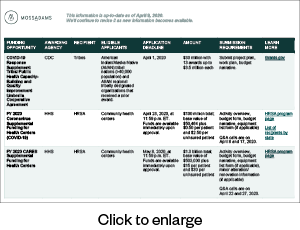

Current Funding Sources

Below is a list of the funding sources available. We’ll continue to update it with new opportunities.

FEMA Public Assistance

FEMA funds are awarded via a state, tribal, or territorial agreement (recipient) and then distributed to government and not-for-profit organizations (applicants). Organizations, including private not-for-profits, district hospitals, nursing homes, assisted living facilities, and clinics, can apply for public assistance once the recipient sets up an account for the applicant. Applicants must use the Grants Portal to submit a Streamlined Project Application for COVID-19-related expenses.

NEW: FEMA will provide a 100% federal cost share for eligible work dating January 20, 2020, through September 30, 2021, according to a presidential memo dated February 2, 2021. This is an increase above the normal 75% federal cost share for other FEMA disasters.

Assistance for emergency protective measures and activities include, but aren’t limited to:

- Management, control, and reduction of immediate threats to public health and safety

- Emergency medical care

- Medical sheltering

- Purchase and distribution of food

Applicants in any state can contact their Moss Adams professional for further information and guidance through this process.

Medicare Accelerated and Advance Payments

Beginning on Monday, March 30, 2020, Medicare providers were able submit Accelerated and Advance Payment Request forms to their Medicare Administrative Contractor (MAC), via the MAC’s website. Their goal was to review and issue payment within seven days.

Additional Resources

- CMS Expands Accelerated and Advanced Health Care Payments During COVID-19

- CMS Provides Updates on Accelerated and Advance Payment Programs

Repayment Terms

On September 30, 2020, Congress voted to relax some program requirements, including extending the deadlines for repayment and reducing the portion of claims that are withheld during the recoupment period.

Details

- Extended the start of the recoupment period from 120 days to one year from date of loan issuance

- Reduced payment withholding from 100% to 25% for the first 11 months, then 50% for the next six months

- If full repayment hasn’t been completed after 29 months from loan issue date, interest will accrue at 4% on the unpaid balance

Philanthropic Funds

Additional funding sources may be available through regional philanthropic organizations for COVID-19 response.

- Philanthropy CA. Select Resources for a list of city, county, and regional organizations in California.

- Philanthropy Northwest. A list of county and regional organizations in Washington, Oregon, Idaho, Montana, Wyoming, and Hawaii.

- Oregon Community Fund. For community-based not-for-profits and small businesses in Oregon.

- Grantmakers of Oregon and Southwest Washington. A list of grant-making organizations’ recent activities.

- Protect the Heroes Campaign. Centralized website for the general public to donate to a local hospital of their choice for purchasing PPE.

Loans

One compelling option is the Small Business Administration’s (SBA) Paycheck Protection Program as well as the Main Street Lending Program. Please see our updated guidance below.

For more insight, see our PPP and Main Street Lending Program spotlights.

Additional Non-Application Based Assistance

Some benefits to help reduce hardship will be given to health care providers universally, without requiring an application or reporting process.

Universal Benefits

- The relaxation of Medicare Quality Payment Program, Merit-based Incentive Payment System (MIPS), and Value-Based Purchasing (VBP) reporting requirements.

- Temporary, enhanced federal Medicaid funding by 6.2% for states.

- A 20% increase in Medicare reimbursement for hospitals discharging COVID-19 patients

- Delayed planned spending cuts to Medicaid DSH hospitals.

- Elimination of 2% sequestration Medicare payment cuts from May 1, 2020, to December 31, 2020.

- Waiver of face-to-face visit requirement for home dialysis, hospice, and home health, which enables telehealth.

- Ability for midlevel providers to refer Medicare patients into home health.

- Blanket waivers of Stark Physician Self-Referral Prohibitions, as related to COVID-19.

- Legal waivers allowing unprecedented use of novel locations as hospital facilities (Ambulatory Surgery Centers, stadiums, dorms, and hotels, for example) and expanded telehealth flexibilities.

- Medicare guidance to Durable Medical Equipment suppliers allowing coverage for upgraded multifunction ventilators, even when not medically necessary.

- Enhanced opportunity for collaboration via joint ventures, research, and other partnerships, due to the Federal Trade Commission and US Department of Justice offering expedited seven-day reviews.

- Delayed deadlines to meet interoperability requirements.

- Ability to earn MIPS credit from new COVID-19 Clinical Trials improvement activity.

- Major updates to the Medicare Shared Savings Program—application cycle, attribution, benchmark and cost calculations, down-side risk.

- Extended deadlines for hospitals and CAHs to submit the Promoting Interoperability hardship exception to September 1, 2020, and November 30, 2020, respectively.

- CMS Innovation Center models announced flexibilities for COVID-19 including updates to financial methodology, quality reporting requirements, and timelines.

- The IRS extended the Community Health Needs Assessment deadline to December 31, 2020.

- At the time of COVID-19 testing or upon a positive result, there’s an additional billing opportunity for counseling patients about the importance of self-isolation after they’re tested and prior to the onset of symptoms.

- To facilitate the efficient administration of COVID-19 vaccines to SNF residents, CMS will allow Medicare-enrolled immunizers, including but not limited to pharmacies, to bill directly and receive direct reimbursement from the Medicare program for vaccinating Medicare SNF residents.

Strategic Considerations

To utilize current and future grant funding, staff must be trained on COVID-19 billing and coding procedures. This will help them provide complete and accurate counts of patients, procedures, and tests specifically related to the disaster.

Thorough record-keeping is essential—both for reimbursable direct costs such as testing kits as well as timekeeping for administrative staff that reflects added tasks and time related to the disaster.

We’re Here to Help

Navigating the application process for federal and state grants as well as other funding sources can be challenging, requires swift action, and oftentimes needs extensive supporting documentation.

And the process doesn’t stop once you apply for the funds. After an application is submitted, you’ll need to have ongoing administration to help receive available funds, account for them correctly, and decipher complex rules and regulations relating to funding overlap.

To learn more about applying for available grants and funding and subsequent administration, contact your Moss Adams professional.