The COVID-19 pandemic has triggered the first major economic downturn since 2008, with bankruptcies expected to rise as otherwise healthy companies find themselves facing potential insolvency.

The COVID-19 pandemic has triggered the first major economic downturn since 2008, with bankruptcies expected to rise as otherwise healthy companies find themselves facing potential insolvency.

Depending on the specifics of your business, filling for bankruptcy could provide a viable option for debt relief and a fresh financial start. However, it’s important to evaluate all restructuring options before deciding to file as creditors are often willing to work with debtors to settle their debts. Financial planning could also be a viable option to resolve financial issues outside of bankruptcy.

Below we outline the different types of bankruptcy, should you determine that’s the right path forward, and how businesses typically proceed through the process—as well as focus areas for your business to consider before beginning.

Bankruptcy Warning Signs

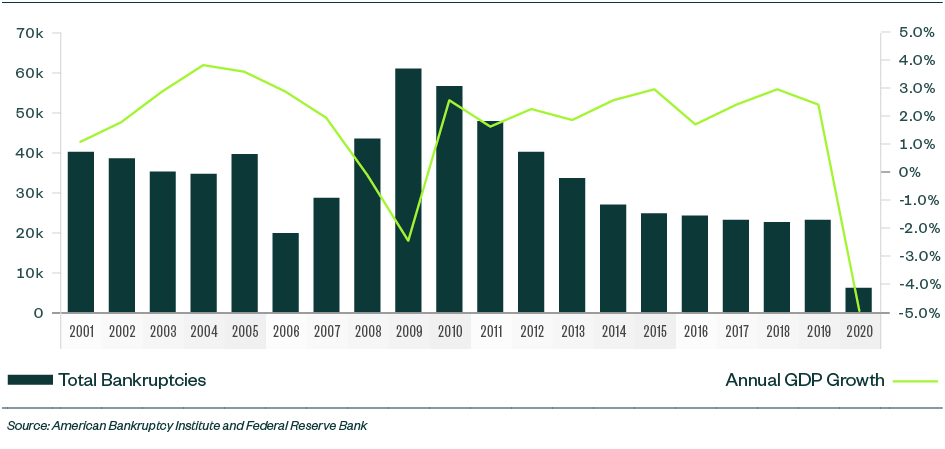

While it will be difficult to predict the exact path of the economy should the pandemic subside, recent historic trends demonstrate the level of bankruptcies often strongly correlate to the GDP growth in the United States.

As the economy steadily rebounded from the 2008 recession, bankruptcies decreased in conjunction with a stabilization of the economy. Should economic recovery emerge over the next few years, there will likely be less prevalence of bankruptcies. However, as the chart below illustrates, the opposite effect is also true in that as GDP growth declines, the number of bankruptcy filings typically increases.

It’s important for business owners and executives to be aware of early warning signs that their company could be in financial trouble.

Recognizing these signs when they first emerge could be the difference between a Chapter 11 restructuring or losing the entire business in a Chapter 7 liquidation.

Warning signs to watch for include:

- Continued decreases in cash flow

- Low cash or capital balance

- Departure of key management or employees

- Inability to meet debt obligations such as loans and lease payments

- Key debt covenants are or soon to be breached

- Difficulty meeting payroll

- Increased interest rates on credit cards due to late payments

- Consistent calls from creditors

- Company executives considering injecting more personal money into the business to satisfy debts or payroll

If after seeing some of these warning signs, the situation becomes too dire or untenable from a financial perspective, there are a variety of bankruptcy options that can help companies weather the storm of near-term economic challenges and persevere long-term.

Types of Bankruptcy

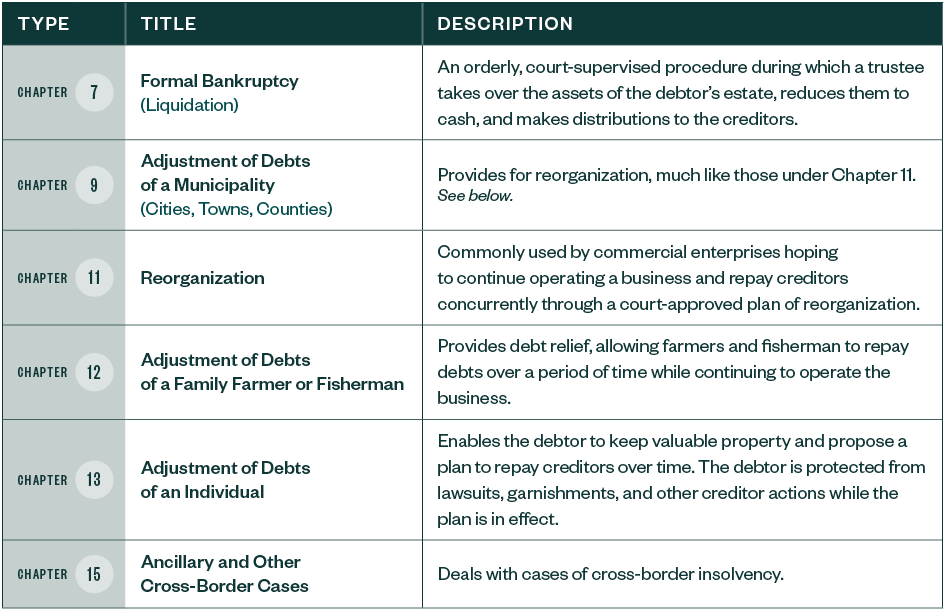

There are six primary forms of bankruptcy, with Chapter 7 and Chapter 11 the most common and well-known.

Each type offers different methods that can treat debt and property differently. Below is an overview of each bankruptcy type.

Federal bankruptcy laws are intended to allow debtors a way out of particularly heavy debts, giving consumers and businesses a fresh start where all other options have failed.

This is usually accomplished through a bankruptcy discharge, a court order releasing the debtor from personal liability for certain debts. The discharge also prohibits creditors or collections agencies from communicating with debtors.

Bankruptcy Process Overview

The process for bankruptcies typically begins with the filing of a petition, which is either voluntary or involuntary.

Once a petition is filed, an automatic stay is put in place by the court that temporality halts foreclosure or repossession. It also stops creditor calls, wage garnishments, evictions, and most lawsuits.

If filling for Chapter 7, the automatic stay is temporary unless the debtor is able to bring the account current. In comparison, the automatic stay for Chapter 11 filings protects the debtor, while the reorganization plan is in-place to repay the creditors.

The main differentiator between Chapter 7 and Chapter 11 elections is whether operations are sustainable at current income levels, or businesses are characterized as a going-concern.

In the event that the business is no longer considered a going-concern entity, Chapter 7 is elected, the company discontinues operations, and an elected trustee liquidates assets on an orderly basis in order to distribute those assets to the claimholders.

Insolvency Tests

To determine the feasibility of a company’s ability to repay its debts, a valuation professional will typically perform a variety of insolvency tests, as detailed below.

- The ability-to-pay solvency test. This is a test of whether or not a company reasonably can be expected to pay its debts as they come due, and is sometimes referred to as cash-flow solvency or equitably solvency.

- The balance-sheet solvency test. This is a test of whether or not the fair value of a company’s assets exceeds the face value of its liabilities and is performed on either a going-concern or liquidation basis.

- The capital-adequacy solvency tests. This is a less-defined test of whether or not a company has adequate capital.

If the company is considered a going-concern entity, a Chapter 11 filing is elected and a reorganization plan is drafted, which proposes the plan for how the company can repay its creditors.

The plan must establish a so-called reorganization value, which represents the fair value of the entity before considering liabilities, and an amount a willing buyer would pay immediately after the restructuring.

Generally, a valuation professional will aid in this determination utilizing a discounted cash-flow analysis. In addition, a cash-flow test is performed to examine the viability of the plan and solvency of future operations.

Fresh-Start Accounting

A fresh-start accounting process could be required to record assets and liabilities at fair value based on the established reorganization value.

Fresh-start accounting essentially allows companies to present their assets, liabilities, and equity as a new entity on the day the company emerges from Chapter 11 protection. Additionally, it includes consideration of identifiable intangible assets.

Once the reorganization plan is put forward, the creditors will vote on the plan, and if approved, put it into action. Under the approved plan, the debtor can reduce its debts by repaying a portion of its obligations and discharging others.

The debtor can also terminate some of its contracts and leases, recover assets, and rescale its operations to hopefully return to profitability. Under Chapter 11, the debtor normally undergoes a period of consolidation and emerges with a reduced debt load and a reorganized business.

Chapter 7 Proceedings

If Chapter 11 proves unsuccessful, or not a viable option and the company is forced into liquidation, it enters into a Chapter 7 proceeding.

This particular form of bankruptcy contemplates an orderly, court-supervised procedure by which a trustee takes over the assets of the debtor's estate, reduces them to cash, and makes distributions to creditors—subject to the debtor's right to retain certain exempt property and the rights of secured creditors.

Next Steps

The restructuring and bankruptcy process is complicated so it’s important to strategize your business needs every step of the way.

Focusing on certain areas of your business can help you better prepare to navigate bankruptcy based on the specifics of your company. Below are several important focus areas for different stages of the process.

- Business valuation. It’s important to have a firm grasp on the quantitative aspects of your bankruptcy proceedings by performing proper solvency testing, establishing going-concern, liquidation, and reorganization of fair values.

- Technical accounting. When a company emerges from bankruptcy, fresh-start accounting, as explored above, is typically required.

- Tax planning. Typically, difficult times for the markets are opportunistic times for taxes. Volatile markets can allow you to reposition your offerings so they can compete more effectively in the present market—or in other target segments—or take profits with little-to-no tax consequences. By focusing on tax credits, incentives, and other opportunities you might be able to boost cash flow or save valuable funds.

- Business recovery analysis. During the restructuring process, you’ll want to look toward the future and how your business can move forward once the restructure is complete. Your business should focus on financial, restructuring, capital, and crisis management strategies to better position itself for a capital raise and financial realignment.

- Business continuity and disaster planning. It’s important to determine risk factors and critical business functions to develop and implement a detailed plan to ensure your business achieves its continuity of operation objectives before, during, and after a disaster.

- Entity restructuring. Determining the ideal entity structure for your business is important so you can optimize your tax and business choices as you grow.

We’re Here to Help

To learn more about how best to navigate a potential bankruptcy or restructuring in your business, contact your Moss Adams professional.