Equity compensation continues to be a popular strategy for companies to attract highly qualified candidates, boost employee engagement, and secure tax savings.

Many companies, optimistic about these benefits, start equity compensation programs without sufficient planning. They’re often surprised to discover the nuanced accounting requirements involved—and the operational systems needed for a program to run smoothly.

Knowing and planning for these potential roadblocks in advance can help companies reap the significant benefits equity compensation has to offer while avoiding the negative consequence that can arise.

The article addresses the following:

- What Is an Equity Compensation Program?

- What Are the Benefits of an Equity Compensation Program?

- What Are the Types of Equity Compensation?

- What Are the Tax Implications of Equity-Based Compensation?

- What Is Mobility Taxation?

- What Are the Challenges of Mobility Taxation?

- How Can an Organization Plan for Mobility Taxation?

- How Does Payroll Reconciliation Affect the Process Flow of Equity Compensation?

- What Are the Challenges of Payroll Reconciliation?

- How Can an Organization Plan for Payroll Reconciliation?

- What Role Does System Integration Play in an Equity Compensation Program?

- What Are the Challenges of System Integration?

- What Challenges Could Automation Introduce to the Process Flow?

- How Can an Organization Plan for System Integration?

- How Can Business Disruption Affect an Equity Compensation Program?

- How Can an Organization Plan for the Effects of Business Disruption on Equity Compensation?

What Is an Equity Compensation Program?

An equity compensation program manages the portions of an employee’s compensation dealing with some type of holdings of company stock.

Companies find it useful to include equity as part of the compensation program to:

- Encourage employee retention

- Promote company ownership

- Provide opportunity to share in company growth

- Provide value to the employees

What Are the Benefits of an Equity Compensation Program?

When implemented well, equity compensation can create a workplace with engaged, talented employees while providing cost-savings for employers. It often results in the following benefits:

- Assists with retaining and engaging employees

- Helps attract top candidates

- Earns extra tax credit

Retain and Engage Employees

By offering employees ownership in the company, equity compensation allows recipients to see a direct correlation between their workplace success and the success of the company—and in turn their stock.

This typically cultivates employees with a strong sense of ownership over their work and investment in the company, which gives a boost to their work ethic and loyalty.

Attract Top Candidates

On the recruitment front, equity compensation can help attract top-tier employees. In a tight labor market, stock options are often a deciding factor for sought-after candidates.

Equity compensation is often a cheaper offering than cash, so companies can offer greater amounts without straining the budget.

Relatedly, hiring managers are usually given more negotiating flexibility with equity compensation, so they can use their discretion to secure top candidates.

Earn Tax Credit

Equity compensation can also reduce a company’s federal tax burden, often amounting to significant savings. For every dollar of qualifying equity compensation an employee is issued, the employer can claim a tax deduction. This can amount to significant savings.

What Are the Types of Equity Compensation?

While there are many forms of equity compensation, the two most popular are stock options and restricted stock:

- Stock options. An employee has an option to buy stock at a predetermined price after a certain future date, regardless of fluctuations in the stock value. This can offer a significant reward if the stock value increases.

- Restricted stock. Shares are given—not purchased—with a restriction, and the employee gets the stock once the restriction lapses. The most common restriction is a waiting period.

In both scenarios, it’s a taxable event when an employee takes their stock value. Without adequate systems and procedures in place, a company can face significant complications.

What Are the Tax Implications of Equity-Based Compensation?

Most of the issues that arise with equity compensation occur in three areas:

- Mobility taxation

- Payroll reconciliation

- System integration

What Is Mobility Taxation?

Mobility taxation comes into play when a company has employees who work in multiple locations that might have a tax claim on equity compensation earned.

Multiple states—or countries—could be able to claim a tax on an equity award if the company granting it has employees who do any of the following:

- Permanently move between states or internationally

- Take a short-term assignment in other locations

- Travel for business

Consider this scenario: An employee is granted an equity award in one location and then moves to another location before realizing the income from the equity award. Both locations might assess a tax on this award. The company might therefore need to withhold and submit taxes on behalf of the employee for both locations.

What Are the Challenges of Mobility Taxation?

There are four main challenges that arise with mobility taxation:

- Tax Calculation and Distribution. Most companies don’t calculate taxes for mobility scenarios, so this issue can take them by surprise when they start providing equity compensation because the complexity involved is significant. The calculation is exponentially more challenging for every location added because companies must determine how to distribute the taxes between locations.

- Ongoing Employee Monitoring. To properly apply mobility taxation on equity compensation, companies need to have thorough, accurate records of each employee’s location over the duration of their employment—down to the day.

- Data Accuracy. In comparison to a nonmobile employee, mobility taxation on equity compensation can create serious data issues that most companies don’t have systems or vendors in place to solve.

- Company Growth. The issues around data collection—such as data collection for mobile employees—and tax calculation compound quickly when companies scale, expanding their equity compensation program and growing their locations.

How Can an Organization Plan for Mobility Taxation?

Solutions to mobility tax complexities vary with the organization, its infrastructure, current systems used, and the number of employees awarded equity. Here are a few solutions companies can consider:

- Custom approach

- Synchronizing between systems and vendors

- Manual tracking in spreadsheets

- Consulting

Custom Approach

A full-scale, custom-built solution offers the most efficiency. It can handle all key steps of the mobility tax process, including collecting employee location data from human resources and other departments, performing the necessary calculations, and sending information to payroll.

Synchronizing Between Systems and Vendors

The company can use existing or new vendors and synchronize the data between them to implement mobility tax processing. More vendors are offering more options around mobility taxation for equity, but not all of them will work for all companies.

This is an attractive solution because everything is already built, but this approach can require more data preparation and auditing efforts by the company staff. It can also require some manual workarounds for specific situations which don’t fit the standard process.

Manual Tracking in Spreadsheets

Some companies choose to track processes and procedures in spreadsheets. While smaller companies can get away with this, the option can present error issues because it relies on manual entry. This method can become impossible to sustain as a program grows.

Consulting

Companies can be reluctant to bring in consultants. But it’s often helpful to have someone come in with a bird’s eye view to help connect the dots. Some possible benefits might include the following:

- Mitigate issues that arise with noncustom solutions

- Assess potential liability for mobility taxation of employee equity

- Review and verify relevant systems and processes

- Implement new systems, as needed, to processes, track, calculate, and report on mobility taxation

How Does Payroll Reconciliation Affect the Process Flow of Equity Compensation?

A critical portion of any company’s employee equity program involves calculating, withholding, paying, and reporting on taxes required by federal, state, or local tax authorities.

At first glance, the process likely seems familiar—an employer withholds tax on equity as they would for other compensation and passes the information to payroll. Payroll then indicates the amount withheld on employees’ W-2 forms as well as transmits the tax to the government.

However, there’s a requirement unique to equity compensation that complicates the process: Companies that report $100,000 or more in taxes to report for a single day must pay the withheld taxes within 24 hours of an employee receiving the benefit.

What Are the Challenges of Payroll Reconciliation?

Companies must have adequate systems and processes in place to comply with this tight turnaround time. However, there are a few more challenges companies should keep in mind:

- Discrepancies. One challenge is mitigating discrepancies between the tax amount calculated and submitted to payroll and the amount payroll actually pays. During the reconciliation process, it’s often discovered amounts don’t match due to factors such as mobility taxation, which is an issue for tax reporting.

- System Errors. It can be difficult to reconcile the reportable income and taxes withheld between the equity systems and the payroll system, particularly if a company is doing so at a large scale or if it needs to account for mobility tax.

- Deadlines and Penalties. Correct, timely reporting and payments are critical. Missing the deadline or needing a W-2 correction comes with serious penalties, including fines.

How Can an Organization Plan for Payroll Reconciliation?

Custom solutions can help a company operate more efficiently and reduce error. Companies can benefit from using a system that automates the following steps:

- Transmit income and taxation information to payroll

- Receive audit reports from payroll with all income and taxes actually reported for equity compensation in payroll

- Identify any discrepancies that need further investigation

It’s essential to have a reconciliation process in place as well as a process for making corrections if needed.

Although small companies can rely on spreadsheets, the manual nature of this approach can create significant potential for error. Eventually, as companies scale, custom solutions become necessary to execute these processes quickly and accurately.

To learn more about an effective reconciliation process, please read our article.

What Role Does System Integration Play in an Equity Compensation Program?

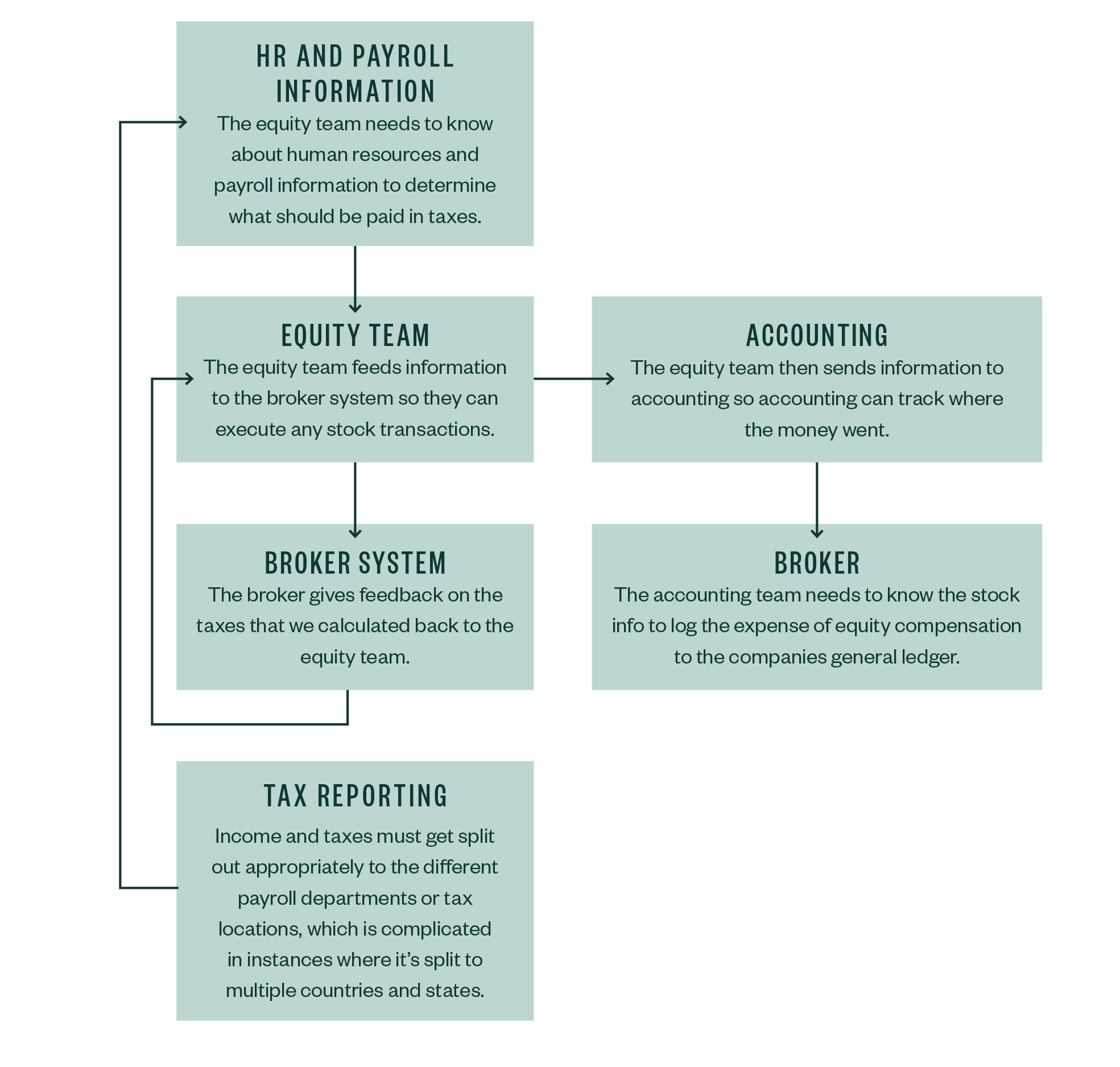

Equity compensation programs require seamless collaboration from a variety of departments—and often, external service providers as well. Here’s an overview of how information flows and through whom in a functional compensation program.

What Are the Challenges of System Integration?

An equity program’s success is contingent on its ability to quickly and efficiently receive and integrate information from a variety of other sources. Finding a system to organize and facilitate this flow of information—as well as determine what information is needed and how often—isn’t easy.

This issue is compounded because the relevant departments’ main focuses often don’t overlap with equity compensation, so knowledge and communication hurdles arise.

A payroll team, for example, typically has familiarity with taxes but little experience with vesting schedules. Unique details can get lost when the departments lack a shared, deep familiarity and language with the many facets of equity compensation.

To learn key considerations for selecting an enterprise system that will assist with integration, please read our article.

How Can an Organization Plan for System Integration?

Companies often come to realize that they don’t have the internal resources to integrate the various stakeholders and systems. An outside consulting firm is often necessary to help bridge that gap to help the different elements communicate so the equity compensation program is successful.

Common services an outside consulting firm can provide include:

- Business process reviews

- Vendor selection and implementation

- Systems integration and internal tool creation

How Can Business Disruption Affect an Equity Compensation Program?

During times of uncertainty, it’s even more important for organizations to consider automation around their equity programs. Having the equity processes automated could provide more consistent, reliable results, limit the reliance on a single individual or tribal knowledge, and free up time to allow resources to concentrate on higher value-add items.

For example, anticipated or unanticipated changes to staff members responsible for the equity processes might be impacted and unavailable to manage the processing.

What Challenges Could Automation Introduce to the Process Flow?

The uncertainty around which staff members will be available to manage the equity processes can introduce additional risks. Questions to consider can include:

- What level of training or familiarity is shared among the staff around the processes?

- What other tasks they might have to complete?

These can increase the risk the equity processing isn’t done correctly or in a timely manner.

How Can an Organization Plan for the Effects of Business Disruption on Equity Compensation?

An organization can plan for business disruption in the following ways:

- Use of automation. Leverage internal or external tools to perform common tasks. Continue to examine exception reports and alerts to catch unusual situations or potential threats.

- Standard operating procedures (SOP). Have each staff member document simple guidelines for standard tasks. Keep them up to date and review on an annual basis. Have alternate people or departments test the SOP and perform the tasks periodically to account for human error.

- Cross training. Identify staff members who can cover one another’s jobs in case of emergencies and provide proper training; SOPs will assist with cross training.

We’re Here to Help

Equity compensation has many moving parts with many pieces to track. If you’d like to understand more about mobility taxation, payroll reconciliation, or system integration, contact your Moss Adams professional.