Why Are SOC Reports Important for Fintechs?

Organizations continuously seeking efficiencies and cost savings often turn to outsourcing. Many have moved data to the cloud and rely on software-as-a-service (SaaS) providers for key business functions. However, as outside providers perform operational duties and store or process data, new risks can arise.

For fintechs pushing the boundaries of what’s possible, a System and Organization Controls (SOC) report is more than a compliance artifact—it demonstrates that innovation is underpinned by governance, that new technologies are deployed with accountability, and that the organization prioritizes operational resilience.

In a market where digital trust is both fragile and essential, SOC reporting enables fintechs to adopt emerging technologies with confidence, while proving to stakeholders that security and integrity remain central to their growth strategy.

Why Do SOC Reports Matter?

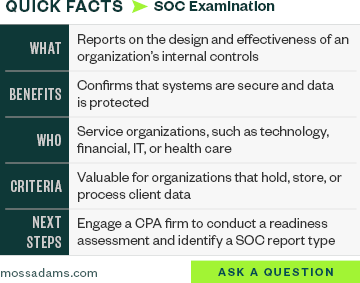

Selecting vendors that provide a SOC report is a pragmatic decision for organizations seeking to mitigate vendor risk. A SOC report, issued by an independent auditor, evaluates the design and effectiveness of a company’s internal controls related to financial reporting (SOC 1®) or data security, availability, processing integrity, confidentiality, and privacy (SOC 2®).

This scrutiny provides assurance that the provider adheres to recognized standards for safeguarding sensitive information and maintaining reliable systems. Engaging with a firm that has undergone a SOC examination demonstrates a commitment to transparency and regulatory compliance. It facilitates vendor due diligence, supports internal governance requirements, and streamlines third-party risk assessments.

For institutions operating in highly regulated environments, such as banking or insurance, partnering with SOC-compliant vendors helps ensure alignment with industry expectations and reduces exposure to operational and reputational risks. In essence, a SOC report serves as a foundational element in building secure and trustworthy business relationships.

Vendor oversight, supported by thorough SOC report reviews, plays a vital role in helping organizations strengthen operational resilience, safeguard sensitive data, and meet rigorous third-party risk management expectations.

To address the risks related to outside service providers, organizations can engage CPAs to perform SOC examinations.

Organizations should obtain SOC reports from all existing and prospective vendors that impact their ICFR program or security posture. Additionally, organizations need to understand how to read and evaluate those SOC reports.

What Needs to Be Considered During Vendor Due Diligence?

The SOC reports should be reviewed with the following considerations in mind.

Type of Report

A Type 1 report covers a point in time and addresses only the design and implementation of controls.

A Type 2 report covers a specific period and addresses both the design and operating effectiveness of controls.

Accounting Firm

The accounting firm performing the SOC examination should be reputable and well-known.

Service Scope

The vendor’s products used by your organization should be covered in the SOC report. Some vendors issue multiple SOC reports covering different products and services, including separate reports for IT general controls.

Covered Period

The SOC report’s examination period should cover a sufficient portion of the concerned period, ideally at least 75% of your fiscal year. Many vendors also issue bridge or gap letters to inform users of material changes since the last report.

Auditor Opinion

The auditor’s opinion should be unqualified. If qualified, any unmet control objectives (SOC 1) or criteria (SOC 2) must be assessed for relevance to your organization.

Description of Processes and Controls

The report should include the controls expected from the vendor and confirm they align with your business’s internal policies and requirements.

Complementary User Entity Controls (CUEC)

As applicable, the SOC report should include CUECs outlining the complementary controls that are necessary along with the vendors controls.

Complementary Subservice Organization Controls (CSOC)

As applicable, the SOC report should include CSOCs outlining the types of controls subservice organizations are expected to implement. Note that CSOCs aren’t directly tested within the vendor’s SOC report.

Testing Results

Any exceptions identified in the SOC report for controls relevant to the organization? If so, does management’s response to the exception address the relevant risks?

To know what type of report to request, it’s helpful to be familiar with the definitions of all SOC reports and their uses.

Building Trust in an Evolving Fintech Landscape

As the fintech industry continues to evolve rapidly, so do the associated risks. Cloud-native architectures, third-party APIs, and decentralized technologies are transforming financial services delivery—but they also expand the attack surface. Cyber threats, operational vulnerabilities, and regulatory pressures are converging, demanding greater control and transparency from fintechs operating in this high-stakes environment.

Today’s attackers target fintech platforms for their rich troves of sensitive data, exploiting weak encryption, poor access controls, and delayed incident response. Meanwhile, the rise of AI in financial services introduces new threats such as algorithmic bias, data poisoning, and model manipulation—risks that demand strong governance and ongoing oversight. In this context, security can’t be an afterthought; it must be built into the foundation.

Regulatory expectations are tightening. Frameworks like the GDPR and country-specific financial regulations raise the bar on data privacy, consumer protection, and third-party risk management. Non-compliance brings more than just fines—it can lead to reputational damage, customer attrition, and loss of market confidence. Fintechs must demonstrate that they understand these risks and are proactively mitigating them.

Where do SOC Examinations Play a Critical Role?

SOC examinations—particularly SOC 1 and SOC 2 examinations—play a critical role by independently validating that a fintech’s internal controls are well-designed and effectively operating. The resulting reports align with trust principles such as security, availability, confidentiality, providing stakeholders with the assurance they need in a digital-first world.

A current, well-scoped SOC report is more than a compliance checkbox—it’s a competitive differentiator. It signals to clients, partners, and regulators that your organization is serious about protecting data and managing risk. It also fosters a culture of continuous improvement by identifying gaps before they become problems and encouraging stronger governance at every level.

In a saturated and fast-moving market, trust is the true currency. Fintechs that embrace transparency, invest in operational maturity, and leverage SOC reports as strategic assets are best positioned to grow confidently—earning not just business, but long-term loyalty.

Emerging Risks and Trends

As fintech companies rapidly adopt emerging technologies such as artificial intelligence, blockchain, cloud-based trading platforms, robo-advisors, AI-powered credit scoring, digital payment systems and embedded finance, their digital ecosystems grow exponentially more complex.

These innovations offer tremendous opportunities for scale and differentiation but also introduce new risks. From smart contract vulnerabilities to data poisoning in AI models, emerging technologies expose fintechs to threats that traditional control frameworks weren’t designed to address.

In this environment, stakeholders—including investors, partners, and regulators—demand proof that these technologies are implemented responsibly and securely.

SOC reporting is evolving in parallel. In addition to existing SOC 1 and SOC 2 reports, SOC for Cybersecurity is becoming increasingly relevant. Regulators and boards are pressing for greater assurance around risk management, making these reports an important tool for validating the effectiveness of an organization’s defenses against sophisticated threats.

We’re Here to Help

To learn more about SOC reporting and how it can benefit your fintech organization, contact your firm professional.