The multifamily rental market remained strong through the first months of 2022. The tight labor market and resulting increase in wages also continue to boost apartment demand even as economic and geopolitical headwinds strengthened.

The apartment sector persisted in outperforming expectations as new tenant demand drove up occupancy. Existing renter households renewed at a high rate after two years of support from stimulus funds and pandemic-related eviction protections.

The surge in house prices, as well as the more recent increase in mortgage rates, is expected to keep homeownership beyond the reach of many households as the costs of ownership rise faster than incomes. Explore economic trends below and how they could impact your business or investments.

Demographic Effect on Multifamily Real Estate

Positive demographic trends combined with strengthened economic performance support elevated apartment demand.

With nearly 67 million people aged 20–34 in the United States, the pool of prime renter age individuals is larger than ever. Additionally, roughly 4.3 million people will turn 18 each year from 2022 through 2030. The unbundling of households coming out of the pandemic also contributed to the rapid acceleration of housing demand.

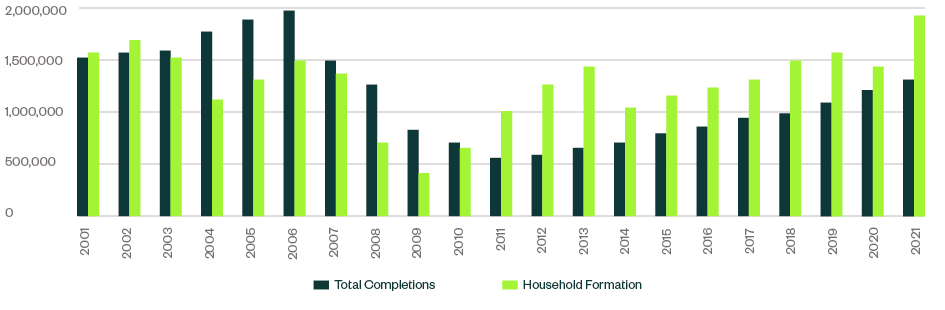

Rosen Consulting Group estimates that roughly 1.9 million net households formed in 2021, in part a result of reversing a portion of the pandemic-related trend of household consolidation, producing a record level of apartment absorption. This is the most households created in one year since the 1980s.

Generation Z Enters the Rental Market

With many individuals working from home at least part of the workweek, roommate arrangements became less desirable, and the number of single person households rose in large metropolitan areas.

While some millennial households transitioned to ownership, Generation Z backfilled apartment units, particularly in urban neighborhoods.

These younger workers leveraged the tight labor market into higher incomes, allowing for more single living situations. They also benefited from student loan repayment moratoriums.

Within the investment-grade apartment segment, the average renter income increased by 10% to 20% in many cities, highlighting the better financial start Generation Z has relative to millennials.

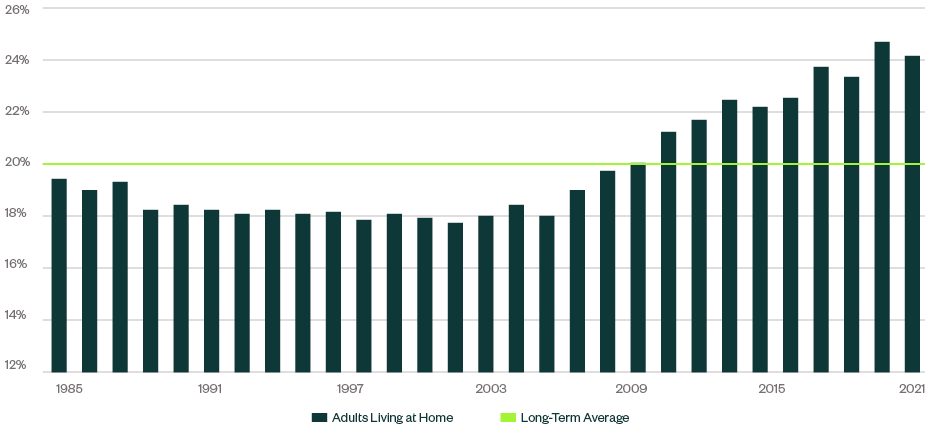

Adults 18–34 Living at Home

National Outlook and Market Variations

The growth in rent with at high occupancy levels isn’t a local market phenomenon and persisted nationwide. Through the first quarter, national rent growth reached 15% compared to 2021.

Aside from a few demographically challenged cities in the Rust Belt and mid-Atlantic regions, asking rents increased at a faster pace than the historical average.

Furthermore, annual rent growth in the double-digits was the norm rather than indicative of a handful of outperforming metropolitan area as nearly all the 20 largest metropolitan areas in the country produced rent growth greater than 10%.

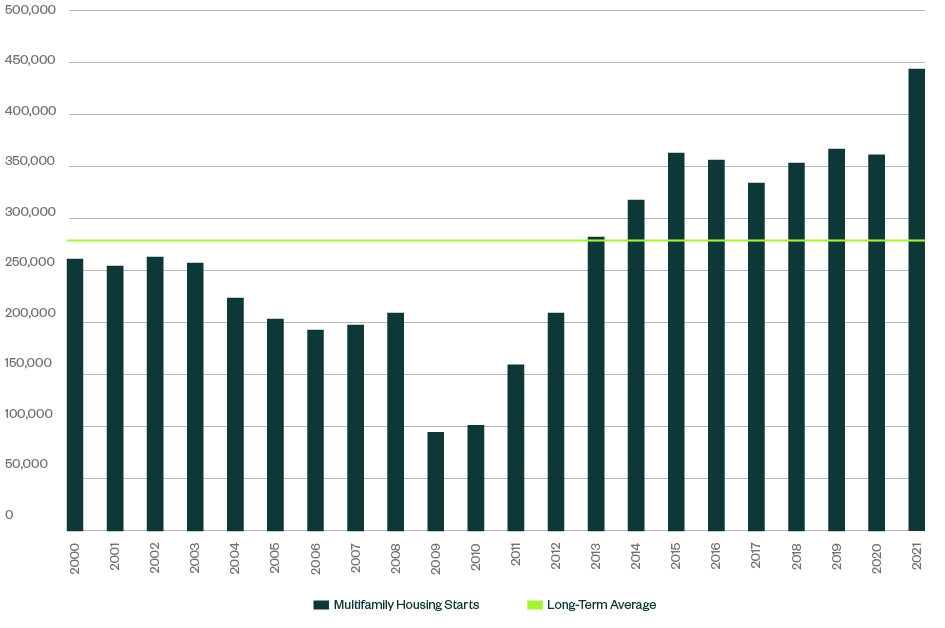

Multifamily Housing Starts

Housing Shortage Trends

The surge in rental demand—as well as diminished concerns about tenant defaults creating vacancies—continued to spur new construction activity.

Housing shortages exists in nearly all cities, but is most evident in large, coastal urban centers and, more recently, secondary, and tertiary growth markets where migration trends accelerated during the last few years.

Construction and Development Boom

Readily available capital and investor appetite for apartments led to a development boom outpacing any period since the 1980s. Rental construction starts increased to 445,000 units in 2021, nearly double the annual average output of the last 20 years.

Despite this apartment construction boom pent-up demand for housing caused by the construction shortfall quickly absorbed new deliveries. The national housing shortage is so severe that it will likely take many years of production to make up for the 3.8 million unit (for sale and rental housing) cumulative deficit created by underbuilding from 2010 to 2021.

In addition to this shortfall, roughly six million more adults than the historical average aged 18–34 now live with family. Spurring just some of these individuals to form their own households could exacerbate the supply shortfall.

While development activity accelerated, the range of supply responses led to variation in market performance. In regions where development hurdles are few and labor costs remain relatively low, apartment deliveries accounted for a larger share of existing inventory.

Housing Production versus Household Formation