There are a variety of factors that influence investment decisions, particularly around stock options, such as investment risk, cash flow, and tax implications.

With effective approaches to stock option management and a financial advisor who offers strategic guidance, you could increase the amount of assets you put to work in your portfolio.

Stock Option Planning to Mitigate Your Tax Burden

If you have incentive stock options, proper tax planning could be the difference between paying federal income tax at the 37% ordinary tax rate or the 20% long-term capital gain rate.

There are two common strategies to convert stock option wealth to long-term capital gains:

- Exercise and hold incentive stock options (ISOs)

- Early exercise and file an Internal Revenue Code Section 83(b) election on your nonqualified stock options (NQSOs)

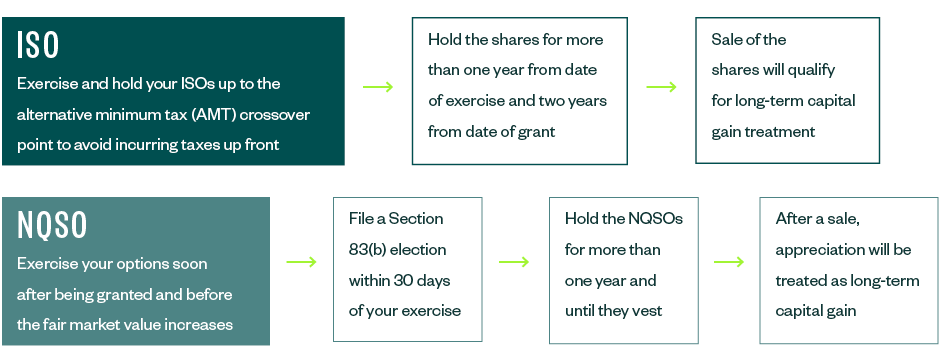

ISO Versus NQSO Strategies

Exercise and Hold ISOs

One strategy is to exercise and hold ISOs up to the AMT crossover point. In this way you can effectively start your holding period on the shares exercised without incurring taxes upfront.

If you hold the shares for more than one year from the date of exercise and two years from the date of grant, then the subsequent sale will qualify for long-term capital gain treatment.

Early Exercise and File a Section 83(b) Election on NQSOs

Another strategy is to early exercise and file a Section 83(b) election on NQSOs. If you exercise your NQSOs when the current fair market value (FMV) is equal to the grant price, there is no option spread and therefore no tax due on the exercise.

This can be accomplished by purchasing the shares shortly after they’re granted and then filing a Section 83(b) election statement with the IRS within 30 days of your exercise. If you then hold the shares for more than one year from your purchase and wait for them to vest, all the appreciation will be treated as long-term capital gain upon sale.

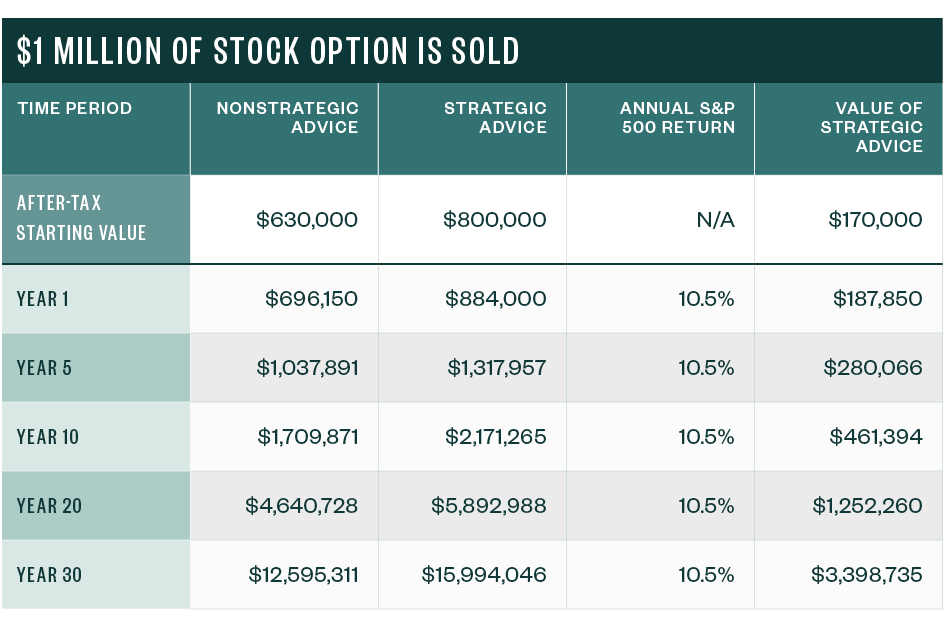

Compounded Value of Stock Option Planning Strategies

To quantify the impact of this 17% tax savings (37% less 20%) on your portfolio over time, the example below assumes you sell $1 million of stock option value at federal ordinary income tax rates versus federal long-term capital gain rates.

Boost Your Investment Strategy

The stock option investment strategies above demonstrate the value of professional personal financial planning advice. There are other strategies that can increase the amount of capital available for investment in your portfolio.

These could include:

- State tax planning. Reducing state taxes can boost your investment portfolio.

- Qualified small business stock (QSBS). Careful planning around QSBS could drastically impact your tax liability.

- Charitable giving. Donating appreciated securities into a donor-advised fund could impact your portfolio over time.

Even if you only earn market-based returns, you can see how the value of professional advice compounding over time could have a dramatic impact on your portfolio.

We’re Here to Help

Learn more about creating an integrated approach to strategic investments, taxes, and estate planning. For further guidance, contact your Moss Adams professional.

You can also find additional insights at our Private Client Practice.