There are many investment strategies and factors to consider when you have qualified small business stock (QSBS), including potential tax implications.

Developing a strategy and overseeing investments yourself can be valuable, but strategic advice from a financial advisor could increase the amount of assets you put to work in your portfolio.

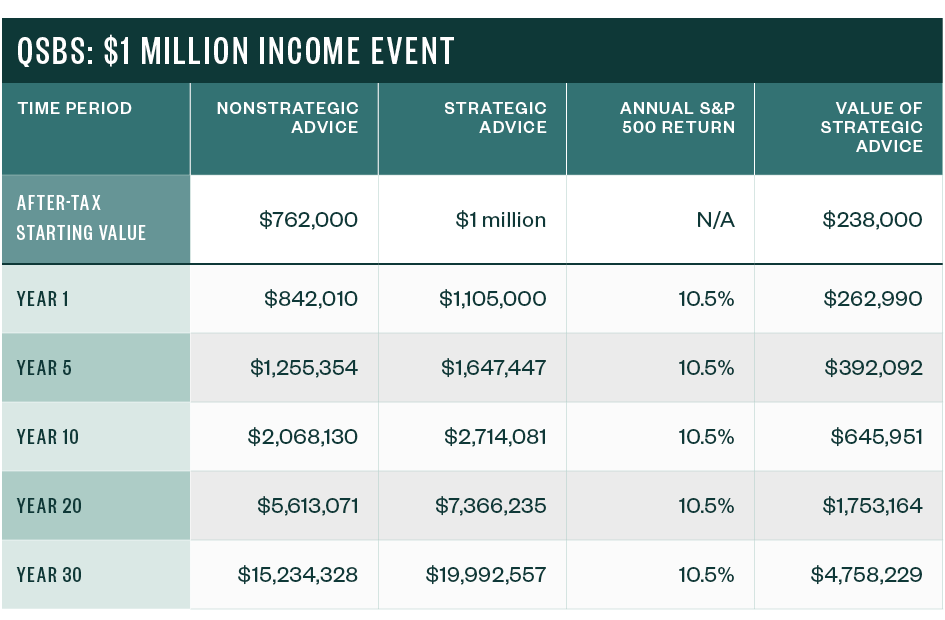

Let’s look at an example of how strategic advice around QSBS could provide compounded value to your portfolio.

Boost the Value of Your QSBS

Section 1202 of the Internal Revenue Code (IRC) provides a 100% exclusion of up to $10 million of federal long-term capital gain when you meet the requirements for QSBS. With careful planning for your stock options or founder shares, this may be the difference between paying 23.8% federal tax or no federal tax.

Not only can you potentially qualify to avoid federal tax on $10 million or more of your QSBS gains, but you could use gifting to expand these benefits to others.

How Planning for QSBS Tax Can Impact Your Portfolio

Suppose you founded a technology company. Shortly after forming the company, you give each of your two children one million shares of your stock when the current value is $0.01 per share, or $10,000 in total. You report the gifts on a gift tax return but aren’t required to pay any gift taxes because the value is less than the current annual exclusion of $16,000.

Now, let’s assume more than five years pass, and you take the company public at a value of $10 per share. Each of your children could now have QSBS valued at approximately $10 million with a cost basis of $10,000. If they sell their shares, each of them may exclude up to $9.99 million of federal capital gains—and potentially state taxes too if their state of residence conforms to the federal QSBS rules.

To quantify the impact of these planning strategies on your portfolio, the example below assumes you have a $1 million income event subject to 20% federal long-term capital gain tax and 3.8% net investment income tax versus the same event meeting the requirements for QSBS and resulting in no federal tax.

Compounded Value of QSBS Tax Planning Strategies

While these requirements may seem straightforward, they can become quite complicated in practice.

To learn more, see Qualified Small Business Stock Is an Often Overlooked Tax Windfall.

Boost Your Investment Strategy

The QSBS tax strategy above demonstrates the value of professional personal financial planning advice. There are other strategies that could help increase the amount of capital available for investment in your portfolio.

These could include:

- State tax planning. Reduce state taxes to potentially boost your investment portfolio.

- Stock options. Know when and how to exercise your stock options for the best outcome.

- Charitable giving. Donating appreciated securities into a donor-advised fund, also known as a DAF, could impact your portfolio over time.

Even if you only earn market-based returns, the value of professional advice, compounding over time, could have a dramatic impact on your portfolio.

We’re Here to Help

Learn more about creating an integrated approach to investments, taxes, and estate planning. For further guidance, contact your Moss Adams professional.