On March 6, 2024, the SEC issued a final rule requiring registrants to disclose climate-related information in their registration statements and annual reports. See additional details in the alert, SEC Finalizes Climate Disclosure Rule, published March 12, 2024.

Without globally accepted ESG reporting standards, organizations face challenges. Producing ESG reporting that meets the needs of varied audiences and also works toward improved business outcomes can be confusing with assessments, disclosures, and standards constantly evolving as organizations respond to regulatory and public input.

Below is a breakdown on how to get started with ESG reporting and an update on ESG standards and criteria.

What Are Your Objectives for ESG Reporting?

Organizations produce ESG reports or disclose specific metrics for many reasons. Clearly stated objectives for ESG reporting can help meet the informational needs of varied audience types. These objectives can focus on a singular requirement or be more comprehensive and include data for an entire ESG reporting program or strategy.

Noting that reporting objectives can evolve over time is also important. As processes for data collection mature and information requirements are refined, continued improvement remains an integral part of the reporting cycle. A multiphase approach to ESG standards can meet both short- and long-term objectives.

Meet a Compliance or Customer Requirement

Public companies or related subsidiaries operating in certain jurisdictions should stay privy to the evolving regulatory environment to comply with emerging requirements.

For example, the US Financial Stability Oversight Council identified climate change as an increasing threat to US financial stability, and the Security and Exchange Commission (SEC) issued a three-rule proposal that would help facilitate comparable ESG disclosures so that statements made to investors wouldn’t be misleading. Municipalities have also begun to develop green investment policies.

Individuals providing legal, compliance, or risk management support can advise on how to adhere to ESG-related regulatory requirements. These teams can also provide insight into the resources required to comply with ESG-related policies.

Make an Impact With a Comprehensive Program

Comprehensive ESG reporting objectives are common in values-based organizations that aim to keep up with compliance requirements, while also striving for ESG reporting that ultimately reflects their values.

Integrated reporting on ESG-related activities across the organization is often built alongside an ESG strategy and governance framework. Organizations may initially hear interest in exploring comprehensive ESG reporting from board members or their audit committees.

For either objective, ESG reporting is an important opportunity for an organization to control its own story. Responding ad hoc to external influences isn’t sustainable in the long term. Keeping strategic business key performance indicators (KPIs) central in reporting can help make sure the data provided remains useful to the organization.

Conduct an ESG Scan

Layering unintegrated initiatives into your organization can result in operational inefficiencies, decreased impact, or failure to reach your desired outcome.

With clear ESG reporting objectives, an ESG scan can help you identify what’s already taking place within your organization, which can help you:

- Make sure there aren’t competing or conflicting initiatives that could negatively impact your ESG reporting accomplishments

- Identify existing performance measures that could be used in your ESG report

- Connect with subject matter experts or passionate individuals who can provide important perspectives or help drive your reporting work

- Assess the internal controls surrounding data collection

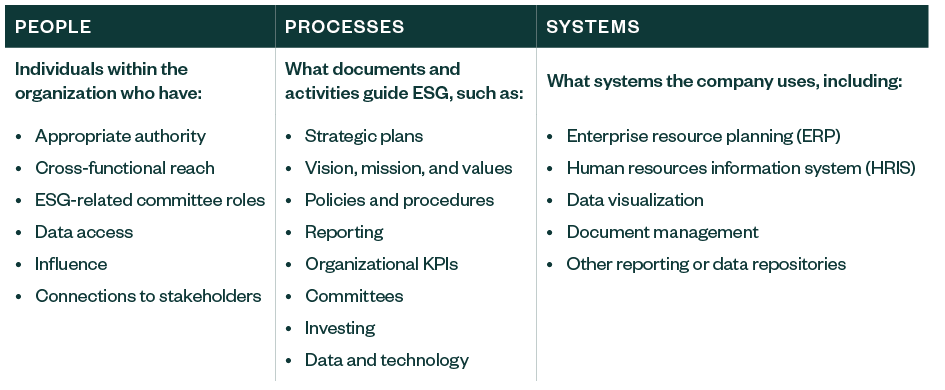

A clear objective will also help to refine your environmental scan to make sure that relevant people, processes, and systems are captured. This will ultimately help you align resources and investments towards accomplishing your desired outcome.

What to Include in an ESG Scan

Align With ESG Standards

Aligning with relevant ESG reporting standards can help an organization focus its report on relevant information. Whether your objective is focused on a singular compliance requirement or a comprehensive program, determining which ESG standards to follow can make alignment the most daunting phase of initial ESG reporting.

ESG Frameworks Versus Standards

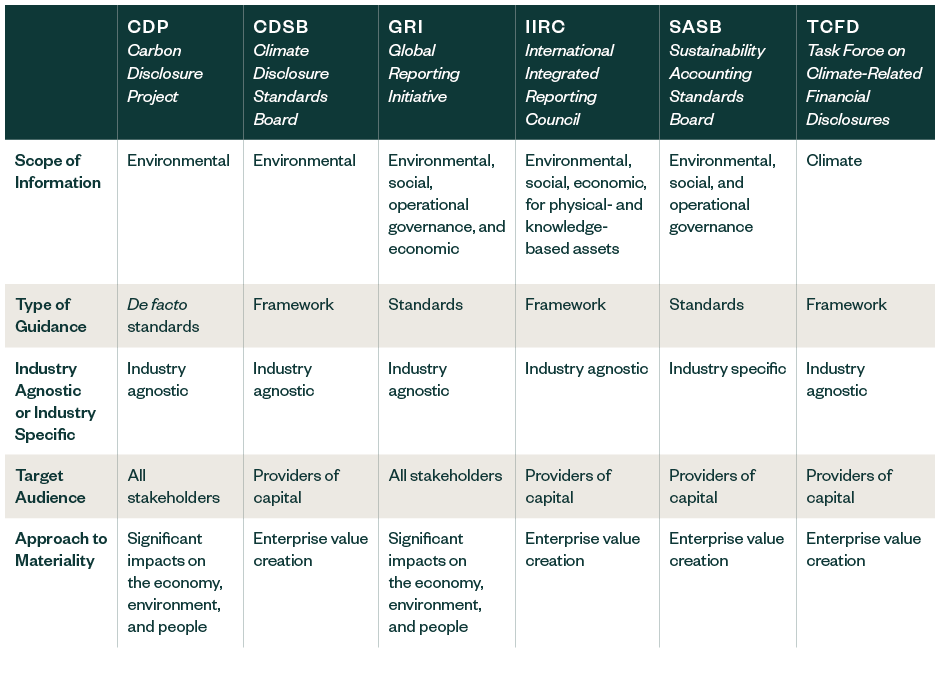

Frameworks provide a set of concepts for how information is structured, prepared, and what broad topics are addressed.

Standards are a set of specific guidance for what should be disclosed. Often, organizations use complementary frameworks and standards to build ESG reports.

Below is a table of the some common ESG standards and criteria, where disclosure frameworks and standards can be compared across the following six organizations.

- Carbon Disclosure Project (CDP). An annual survey where organizations report data related to environmental risks and opportunities, graded A to F. Due to its uptake, the survey has become a de facto set of standards.

- Climate Disclosure Standards Board (CDSB). A framework for reporting environmental information including principles to follow when disclosing environmental information.

- Global Reporting Initiative (GRI). Standards to help organizations report significant impacts on the economy, environment, and surrounding society. GRI also includes reporting principles to define report content and quality.

- International Integrated Reporting Council (IIRC). IIRC issues the international reporting framework that helps organizations communicate capital interdependencies through a cycle of integrated reporting.

- Sustainability Accounting Standards Board (SASB). Helps organizations globally report financially material sustainability information across all ESG areas.

- Task Force on Climate-Related Financial Disclosures (TCFD). A principles-based framework for climate-related financial disclosures along with recommendations for companies to address climate risks and opportunities in financial filings.

ESG Standard and Framework Criteria

Sustainability Accounting Standards Board (SASB) standards are now the property of the International Financial Reporting Standards (IFRS) Foundation’s ISSB, but they remain a widely used set of ESG standards.

Build Your ESG Reporting Road Map

Apply your objective, and results from the ESG scan, to address the following questions and refine your approach to the ESG report.

Why Are You Providing an ESG Report?

This group of further questions will help address your motivating factors. While much of this will have already been considered when establishing your objectives, it’s helpful to revisit motivating factors.

- What caused you to think about ESG reporting? Was it internal factors, external pressure, or something else?

- What are the risks for not accomplishing the ESG objective?

- Are there differing opinions within your organization about ESG?

Who Is the Audience of Your ESG Report?

Aim to refine the target audience of your ESG reporting efforts to help the right information is reach the right people in the right way.

Some additional questions could include the following.

- Who will be the recipient of the reporting or disclosures? Regulatory agencies, customers, vendors, or staff?

- What are the most important things to know about the ESG work?

- Are there other groups asking for the same information that could be included in communications for maximum impact?

How Will Your Organization Complete an ESG Report?

Considerations in this category drill into the ability of your organization to complete the work. Other questions to ask could include:

- Who’s already working toward ESG? This should be captured during the ESG scan.

- Does the team pursuing our ESG reporting initiatives have sufficient expertise, authority, and influence?

- Are there enough resources to develop an ESG report?

- In what areas will your organization need third-party resources?

Final Thoughts on ESG Reporting

It’s important that standards and frameworks try to stay industry-relevant, yet there will be instances where the information requested doesn’t relate to your organization. When this happens, you may choose to omit that metric or modify the metric to accurately reflect your business state.

Where metrics are omitted or modified, provide additional context into what changed that could increase transparency and lend credibility to your report.

Additionally, your organization may not have processes in place for collecting quantitative data. When this happens, many organizations provide qualitative data as context for the metric. This could also include the steps in place to provide quantitative data in the future.

Organizations can use several types of reporting methods to share ESG information. Data tables, dashboards, integrated filings, and stand-alone reports are all widely accepted report formats.

We’re Here to Help

For more information on ESG reporting, contact your Moss Adams professional.