Typically, general partners can receive carry in the range of 20% of the profits earned by the fund, but this can be determined in different ways depending on the specific terms of the fund's partnership agreement.

Some examples follow.

20% of Profits Above a Hurdle Rate

This is a common structure for all fund types, where the fund managers, or general partners, receive a 20% share of the profits above a certain minimum rate of return, known as the hurdle rate. For example, if the hurdle rate is 8%, the fund managers would only receive carried interest on profits above 8%.

Catch-up Provision

The fund managers receive a higher percentage of profits once the investors receive their initial capital plus a certain rate of return. For example, the fund managers might receive 20% of profits until investors have received their capital back plus a 10% return, and then 25% of profits after that.

Time-based

In some cases, carried interest may be determined based on the length of time the fund has been in operation. For example, fund managers might receive 20% of the profits if the fund is sold within three years, but 25% if it’s sold after three years.

How to Value Carried Interest in PE and VC Funds

The value of carried interest is the future potential payout adjusted for risk of achievement. The valuation approach used to determine the fair value of a carried interest will depend on several factors, but typically the discounted cash flow (DCF) income approach will be utilized.

This allows for modeling a variety of potential assumptions and return structures, such as changing management fees, allocation waterfalls, return assumptions and hurdles. The following are some of the primary elements used to constructing the financial modeling and solidify the valuation approach:

- Fund structure. Closed-end funds, fund of funds, hybrid funds, etc.

- Fund agreements. Expected life of the funds, profit allocations, distribution provisions, management and advisory fees, hurdle rates of return, and other rights, preferences, and provisions that may impact value.

- Fund stage. Early stage, later stage, and historical and projected returns.

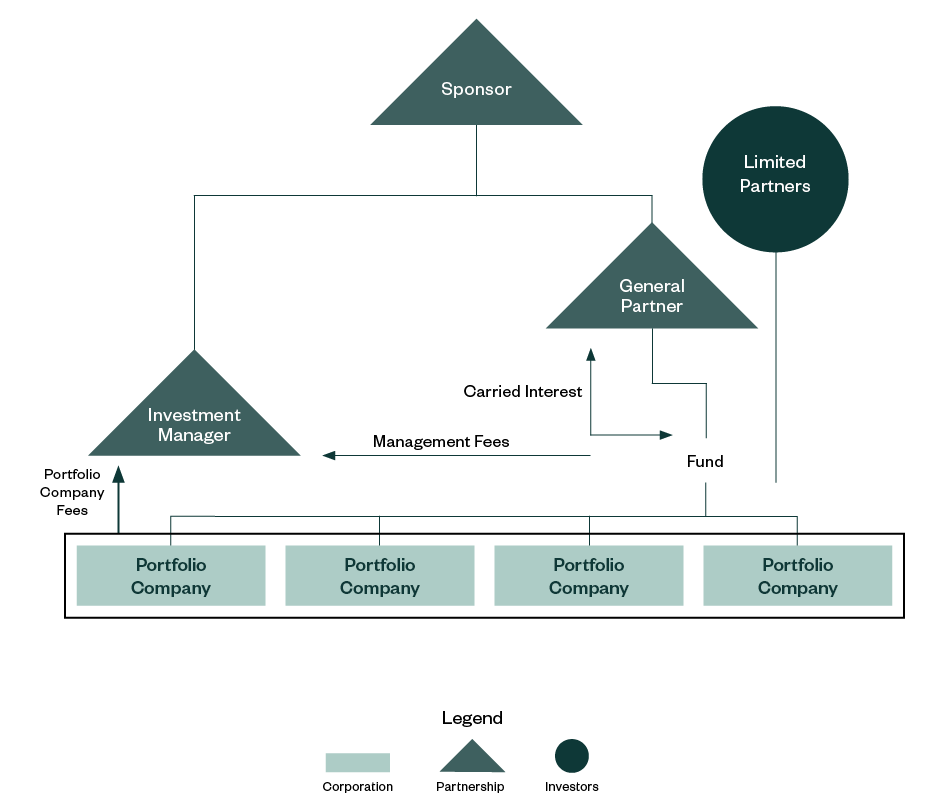

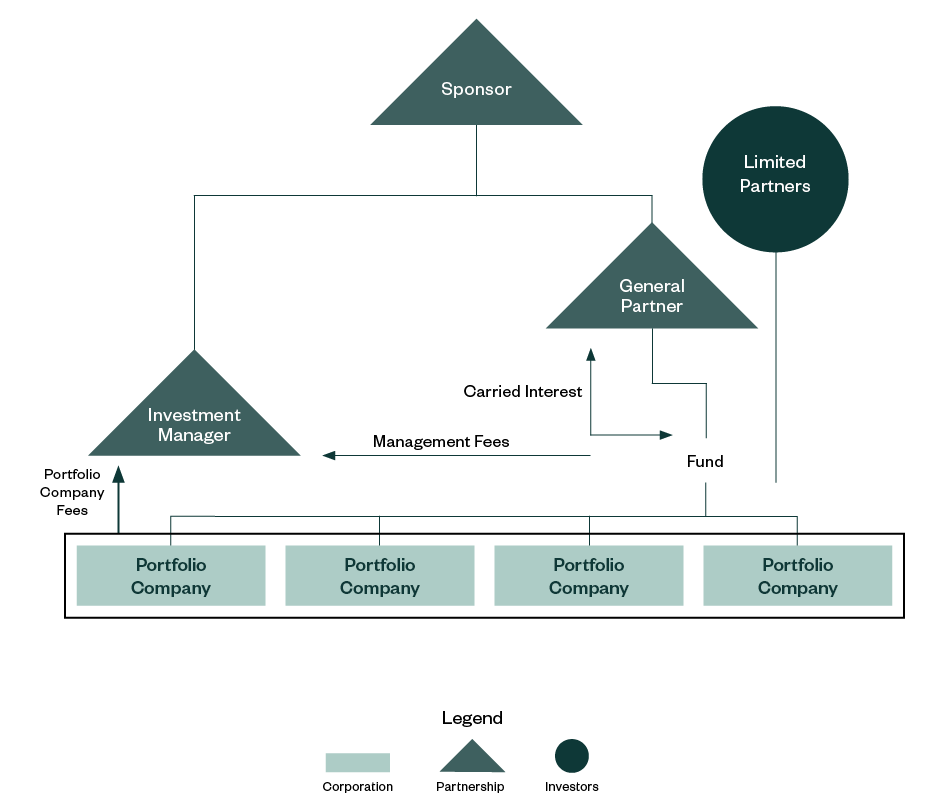

Private Equity Domestic Structure

Additionally, we leverage market data, industry studies, and our internal expertise to develop important assumptions, such as:

- Discount rates

- Expected returns

- Minority and liquidity discounts

- Alternative valuation approaches that may include an option pricing or Monte Carlo simulation model

These models feature closed form equations that are beneficial in modeling a wide range of multiple future states but are difficult to adjust for special provisions that may exist in fund agreements.

What Are the Most Significant Assumptions that Impact Value?

Fund Agreement Provisions

Understanding the fund agreement is critical to our selected approach when valuing a carried interest. For modeling purposes, understanding the term of the fund as detailed in the agreement, the various rights and preferences as outlined in the agreement, and the liquidation provisions are some of the most critical important assumptions.

Discount Rates

We use market data—primarily from public comparable companies—to construct a discount rate based on the capital asset pricing model (CAPM). Additionally, we consider studies that research rates of return for both PE and VC funds, where available. It’s critical to consider the risk profile of the fund’s underlying investments.

Fund Performance

We consider historical performance of the funds, input from management, as well as market data when modeling a DCF scenario. Considering performance of sister funds and other funds with similar prospectuses is helpful. Broad fund indices can be considered here as well.

Applicable Valuation Discounts and Their Benefits

After you determine the value of potential carried interest in the future, you might still have work to do. If you’re going through this exercise to determine value for a tax compliance reason, there are more elements to consider.

Owners of general partner interests completing an estate plan or looking to get gifting completed prior to a potential sunsetting of the current lifetime exclusion amounts will want to know they can transfer carried interest at a discounted value, thus reducing tax liability.

A carried interest valuation professional can help determine appropriate discounts to the concluded carried interest value. In particular, the discount for lack of marketability (DLOM) is applied in a valuation context because no market exists for minority interests in closely held entities—such interests are illiquid.

Valuation services will look at certain characteristics that may influence the magnitude of the DLOM such as fund term, expected volatility, and the relevant rights and preferences detailed in the fund agreement. All else equal, the more volatile the potential returns of the fund and the longer left until the end of the fund life, the higher the potential DLOM applicable.

Life of Fund: Discount Impact

If the carried interest rights are held by a general partner and a non-controlling general partner interest is being transferred, then an additional discount for lack of control (DLOC) is also applicable. This discount attempts to quantify the effect on value to a buyer of the interest who won’t enjoy prerogatives of control such as investment choice, management policies, or fund extensions. While a DLOC is usually not as large as a potential DLOM, it still can have a significant impact.

Carried Interest Tax Provision Overview

Carried interest is a controversial topic, as some argue it allows fund managers to earn large sums of money without taking on as much risk as investors, while others argue it’s a necessary incentive for fund managers to work hard to generate strong returns for their investors.

The taxation of carried interest has also been a topic of debate, as it’s currently taxed at the long-term capital gains rate, which is lower than the ordinary income tax rate.

Significance of Valuation and Taxability of Carried Interests

Fund managers typically receive significant economics through the form of carried interest. The fund managers avoid immediate taxation on grant of carried interests, as these are structured to fall within the safe harbor provisions per the Revenue Procedure 93-27 issued by the IRS.

Revenue Procedure 93-27 defined profits interest as a partnership interest that isn’t a capital interest, and defined capital interest as “an interest that would give the holder a share of the proceeds if the partnership’s assets were sold at fair market value and then the proceeds were distributed in a completed liquidation of the partnership”.

The determination of whether an interest is a capital interest or a profits interest is generally made at the time of the receipt of such interest and evaluating liquidation value is significant in determining classification of interest on the date of receipt and its taxability.

The IRS extended and clarified the safe harbor in Revenue Procedure 2001-43 specially by describing conditions under which the grant of a substantially nonvested profits interest, and its vesting, won’t be treated as a taxable event to the recipient or the partnership. If those conditions are met, the service provider recipient will be treated as receiving the interest on the date of its grant, which is significant for the purpose of evaluating liquidation value.

Overall, fund managers avoid immediate taxation on receipt of carried interest. Furthermore, as partners in the investment partnership, to the extent applicable, the capital gains that make up the carry allocations retain their character.

Recharacterization of Gain Rules Under IRC Section 1061

Carried interests are received in exchange for services, and per IRC Section 1061, these interests fall under the definition of applicable partnership interests (API).

The lower rates that apply to long-term capital gain from sale or exchanges of capital assets of partnerships shouldn’t be available to holders of API interests unless extended three-year holding period requirements are met. So, IRC Section 1061 causes recharacterization of capital gains that make up these carry allocations as short-term gains if the three-year holding period isn’t met on gain from sale and exchanges of capital assets of the investment partnership.

Transfer of Carried Interest to Related Persons Through Sale or Gifting

Per IRC Section 1061(d), the recharacterization of gain rules apply on any gain recognized by a taxpayer due to taxable transfer of API interests, directly or indirectly, to a related person. A related person is defined as a member of the taxpayer’s family, or a current or past colleague.

Gifting of carried interest is subject to the provisions of IRC Section 1061-2(a)(1)(i), and an API remains an API in the hands of the transferee. The recharacterization of gain rules will continue to apply to the beneficiary if the general partner transfers his carried interest through gifting as part of their estate tax planning.

Another consideration for fund managers is whether they can only gift carried interest and not their ownership interest in the fund. IRC Section 2701 looks closely at the value of interest retained by the transferor in transfers involving partnerships and corporations with multiple classes of ownership interests. Therefore, due to implications of IRC Section 2701, in addition to the carried interest actually transferred, the IRS may potentially consider some portion of the retained ownership interest as a deemed gift as well.

Changing tax law, including potential increases in capital gains rates, make plans for gifting, or timing of realization on gains a necessary topic of discussion with your tax professional and financial advisor.

Next Steps

Owners can benefit from current low valuations for equity and PE investments after years of historically very high valuations.

Find a Professional

A valuation professional often has experience valuing both general partner and limited partner interests, including carried interest, in PE and VC funds for estate planning and gift reporting purposes.

In determining the fair value of a particular interest, a professional will consider applicable accounting standards, rely on their experience and knowledge in valuations, as well as work with clients and advisors to develop appropriate assumptions.

We’re Here to Help

For additional carried interest valuation support, contact your Moss Adams professional.

Additional Resources