Clean energy-related projects could help your organization reduce its energy costs, increase cash flow, and receive cash in the form of a refundable tax credit.

What Is a Refundable Tax Credit?

A refundable tax credit is a type of tax incentive that allows organizations to reduce their tax liability and receive a cash refund if the credit exceeds the amount of taxes owed.

What Is IRC 6417?

Under the Inflation Reduction Act, Internal Revenue Code (IRC) Section 6417 established a mechanism for applicable entities to treat certain energy tax credits as a payment against their federal income tax by making what the IRS terms as an elective payment.

This is referred to within the industry as direct pay. For projects placed in service after January 1, 2023, direct pay makes certain clean-energy tax credits eligible for a cash refund.

Who Does IRC 6417 Apply to?

The following applicable entities could be eligible for this refundable tax credit.

Entities That Could Qualify for IRC 6417

What Projects Qualify for IRC 6417?

Credits generated from the following types of technologies, among others, qualify for elective payment for applicable entities.

Qualifying Projects for IRC 6417

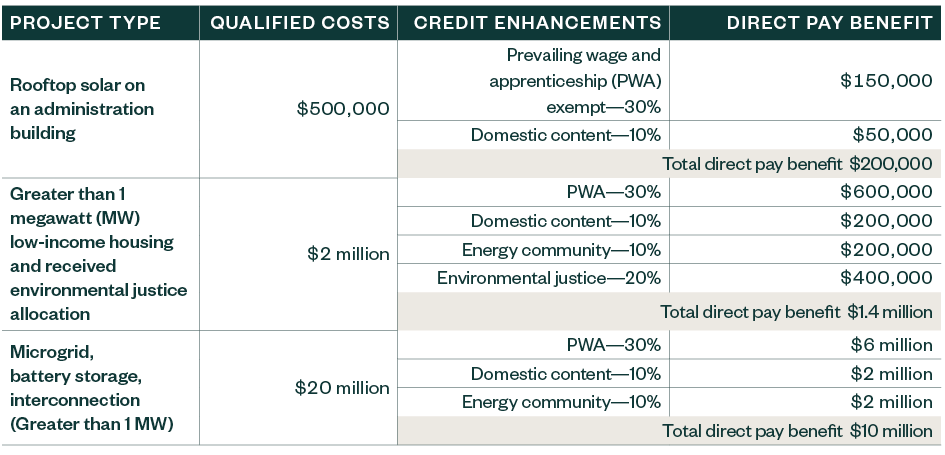

Examples of Inflation Reduction Act Projects and Benefits

These are examples of how much an organization could receive under IRC 6417.

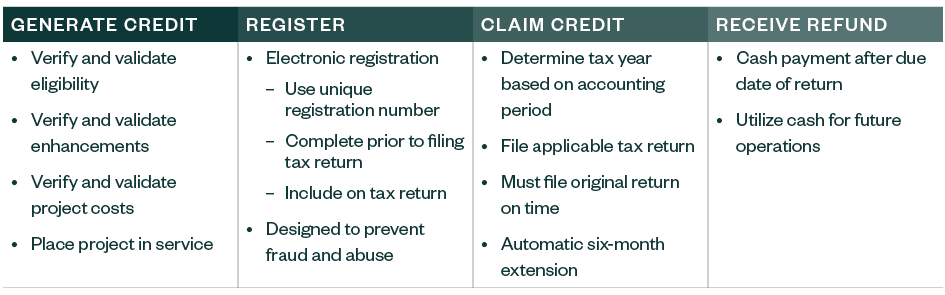

Steps to Receive a Refundable Tax Credit

Below is an overview of steps to take when generating and claiming a refundable tax credit.

When to Start Exploring Direct Pay

There are multiple considerations related to the credit enhancements that should be documented during a project to ensure compliance with credit rules.

Clean energy projects must be registered with the IRS to take advantage of direct pay provisions. The IRS has indicated taxpayers must allow sufficient time to register their projects to allow the IRS to provide a project registration number. Failure to obtain a registration number will disqualify a taxpayer from receiving direct pay.

We’re Here to Help

For further guidance on how your organization can claim these credits, contact your Moss Adams professional.