The annual Medicare cost report is a critical document for cost-based reimbursed providers, such as critical access hospitals, whose payments are based on this report.

According to the Centers for Medicare & Medicaid Services (CMS), “Medicare-certified institutional providers are required to submit an annual cost report to a Medicare Administrative Contractor (MAC). The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data.”

On August 26, 2020, the CMS released updated information in the Medicare Fee-for-Service Billing FAQ document. Prior to that, there wasn’t clear guidance on how the Provider Relief Fund (PRF) and other COVID-19-related financial benefits, such as payroll tax deferral, would be treated on the cost report.

Background

The PRF is $175 billion authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Paycheck Protection Program and Health Care Enhancement Act.

The PRF has been given to health care providers in various distributions, starting on April 10, 2020, as well as via claims-submission to the Uninsured Program. Medicare- and Medicaid-enrolled providers are generally eligible for a payment of 2% of their annual patient revenue, plus any additional targeted allocations that may be applicable. Rural providers or nursing homes, among others, are examples of those that were eligible.

Medicare Cost Report Guidance

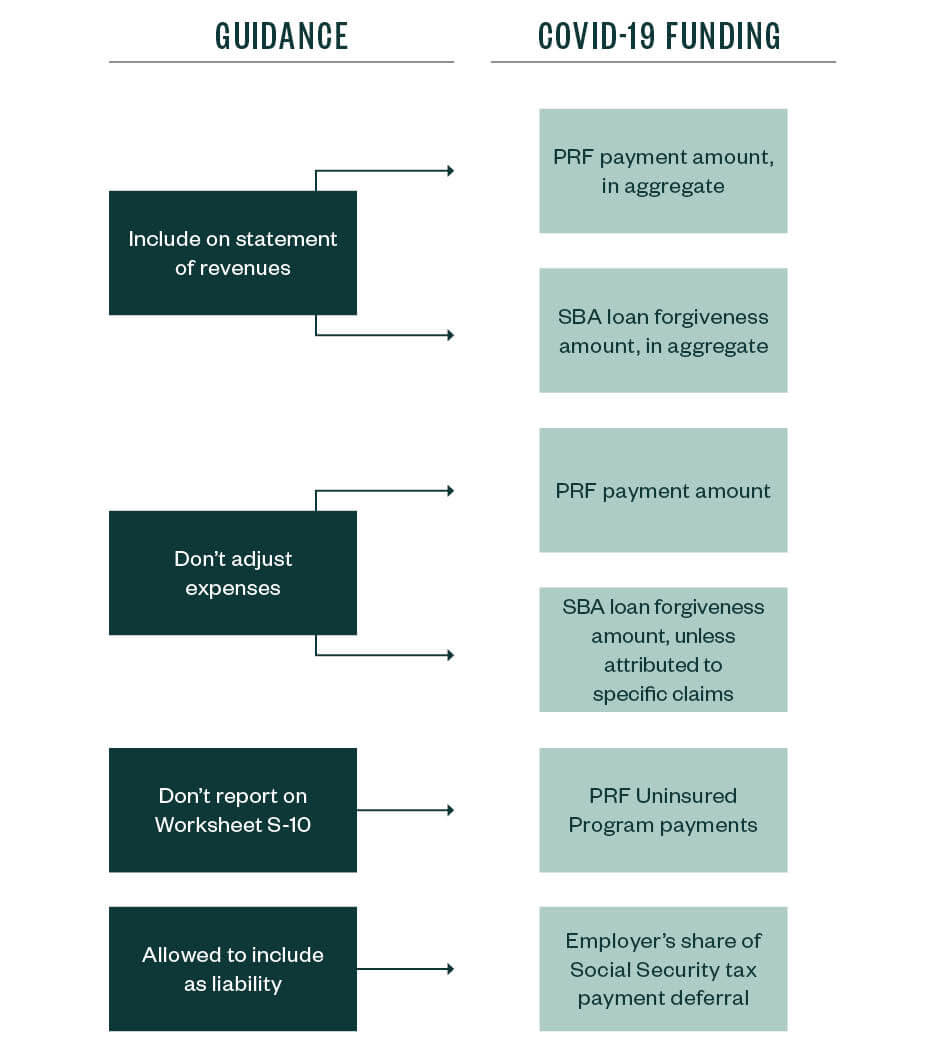

Following is a breakdown of how to report COVID-19 funding on your cost report.

PRF Payment Amount

Providers must report PRF payments in aggregate on the statement of revenues, and the revenue amount must be classified as “COVID-19 PHE PRF.”

For a comprehensive list of PRF program payments that should be reported in the category, please refer to the PRF website or our frequently updated article that details COVID-19 grants and funding updates for the health care sector.

Expenses: PRF Payment Amount

Providers shouldn’t adjust expenses on the cost report based on PRF payments, including use of the funds toward lost revenue.

Providers must adhere to federal guidance regarding appropriate use of funds, as outlined in the PRF terms and conditions and FAQs. This includes ensuring “the money is used for permissible purposes (namely, to prevent, prepare for, or respond to coronavirus, and for health care related expenses or lost revenues that are attributable to coronavirus)” and that PRF money isn’t used “to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse,” according to the new guidance.

PRF Uninsured Program Payments

Subsection (d) hospitals that utilize the Inpatient Prospective Payment System (IPPS) must not report charges reimbursed by the PRF Uninsured Program on Worksheet S-10 of the cost report.

SBA Loan Forgiveness Amount

Small Business Administration (SBA) forgiveness for a Paycheck Protection Program (PPP) loan must be reported in aggregate on the cost report’s statement of revenues, using the same field that PRF payments are reported.

If the provider doesn’t receive forgiveness for a portion of the PPP loan, the provider reports no forgiven amount for this portion. If the provider pays interest on any portion of loan, the provider may report the interest expense, similar to other interest expenses.

It’s likely you won’t know if your loan is forgiven and by how much until 2021, which will have implications on your tax planning and financial reporting.

Expenses: SBA Loan Forgiveness Amount

Providers shouldn’t offset the PPP loan forgiveness amount against expenses on the cost report, unless the amounts can be attributed to specific claims, such as payments for uninsured.

The PPP loan is designed to provide an incentive for businesses to retain their workers on their payroll. The SBA loan forgiveness is available to recipients who meet employee retention criteria and use the funds for eligible expenses, as outlined in the FAQs.

Employer’s Social Security Tax Payment Deferral

Providers that elect to utilize the employer’s share of Social Security tax payment deferral may expense this liability on the cost report in the year the costs were incurred.

This must be done in accordance with 42 CFR 413.100(c)(2)(i)(B), which states “if, within the 1-year time limit, the provider furnishes to the contractor sufficient written justification (based upon documented evidence) for nonpayment of the liability, the contractor may grant an extension for good cause. The extension may not exceed 3 years beyond the end of the cost reporting period in which the liability was incurred.”

Contractors may grant extensions for good cause for COVID-19 related deferrals of the employer’s share of Social Security taxes that were permitted under Section 2302 of the CARES Act.

Section 2302 of the CARES Act allows employers to defer the deposit and payment of the employer's portion of Social Security taxes and certain railroad retirement taxes that would have otherwise been required to be made during the payroll tax deferral period of March 27, 2020–December 31, 2020.

Employers are then required to deposit 50% of the deferred taxes on or before December 31, 2021, and the remaining 50% by December 31, 2022. However, if employers received SBA loans and such loans were forgiven under Section 1106 of the CARES Act, they aren’t eligible for this tax deferral relief.

Guidance at a Glance

Considerations for Providers

Careful tracking and reporting of all payments and expenses identified above are critical for proper cost report settlements and rate setting.

The lasting effects of COVID-19 both operationally and economically could affect federal and state funding for many years to come. Providers will need to follow all prescribed reporting instructions and evolving guidance to avoid unintentional consequences when it comes to reimbursement and future reporting and distribution of aid funds.

We’re Here to Help

To learn more about cost reports, PPP loan forgiveness, and how to document and report on your usage of the PRF, contact your Moss Adams professional. You can also explore our Health Care Spotlight, which details strategies and opportunities when managing COVID-19 disruption.

Special thanks to Scott Murphy, staff, Health Care Consulting, for his contributions to this article.