A previous version of this article was published on April 20, 2022, by the Portland Business Journal.

Reducing energy consumption in the real estate sector is one way to help mitigate the impacts of long-term climate change. Tax benefits are available to companies that construct and design qualifying energy-efficient buildings.

For real estate developers and investors, there’s a plethora of cost-saving opportunities as a result of the Inflation Reduction Act of 2022, which are intended to incentivize the construction of energy-efficient buildings.

Real estate developers and owners, as well as designers of certain building types, could stand to benefit from these tax credits and incentives on both past and current construction projects.

Specifically, there are two incentives to explore for qualifying developments:

- Internal Revenue Code (IRC) Section 45L tax credit. The IRC Section 45L new energy efficient home credit was increased and modified starting in 2023 and extended through 2032. This may be particularly beneficial to residential multifamily developers and single-family home builders.

- IRC Section 179D deduction. The IRC Section 179D energy-efficient commercial building deduction was dramatically increased, making it especially impactful for the architecture, engineering, and construction industries as well as commercial and residential rental building owners.

Impacts of Inflation Reduction Act on IRC Section 45L Tax Credit

This credit provides incentives for residential homebuilders and multifamily developers to reduce energy consumption in newly constructed residences by offering a per dwelling unit tax credit up to:

- $2,000 per unit through December 31, 2022

- $500–$5,000 per unit for multifamily properties completed January 30, 2023, through December 31, 2032, or potentially up to $2,500 per unit if construction began prior to January 29, 2023

- $2,500–$5,000 per unit for single-family properties completed January 1, 2023, through December 31, 2032

Who’s Eligible

A dwelling unit is generally considered eligible for the IRC Section 45L tax credit if the unit is in a newly constructed or substantially renovated residential building, meets certain energy reduction standards, and is certified by a qualified third party. The IRC Section 45L credit can still be claimed on a lookback basis by amending open prior year tax returns.

Through the end of 2022, single-family home developers and multifamily developers constructing new residences of three stories or less—not including below-grade parking—may claim the credit. Starting in 2023, IRC Section 45L now applies to residential developments and multifamily buildings of any story height.

Examples of Qualifying Properties

Qualifying properties include:

- Multifamily properties, such as apartments, townhomes, and duplexes

- Senior housing facilities

- Student housing

- Single-family homes

- Manufactured and mobile home parks

Impacts of Inflation Reduction Act on the IRC Section 179D Deduction

Historically, this deduction has only been for taxpayers that construct or renovate commercial and residential rental buildings of four stories or higher and those that design buildings owned by government entities. This deduction is a permanent part of the tax code and doesn’t expire.

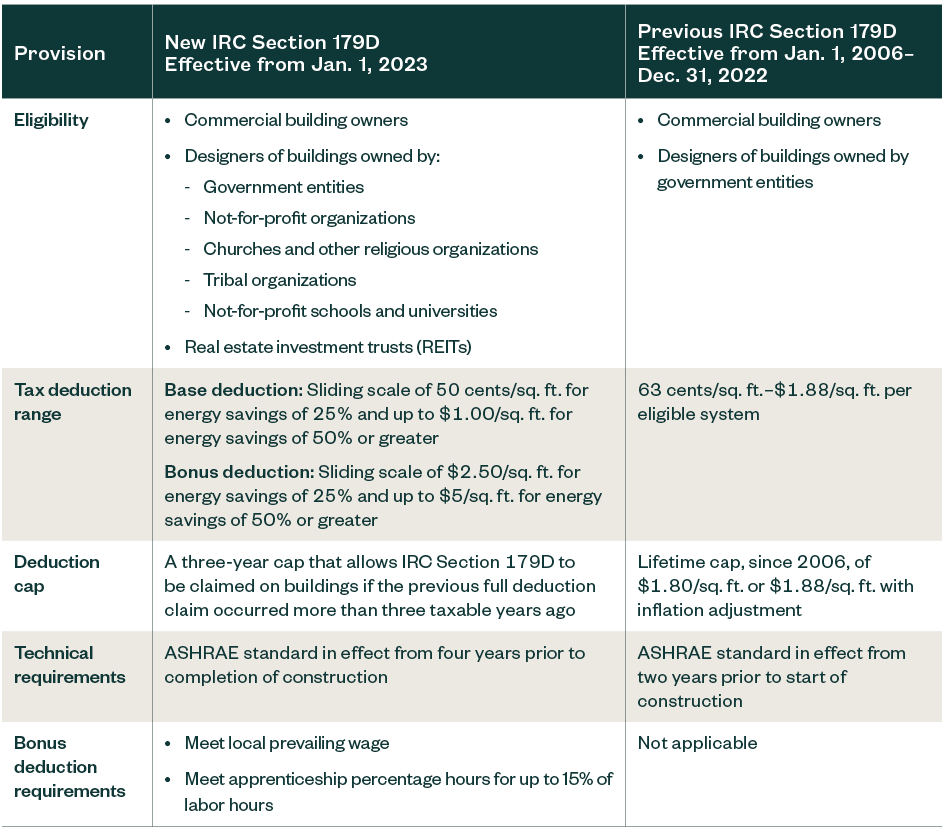

The Inflation Reduction Act included changes to the IRC Section 179D deduction, the two most significant being:

- Expanded eligibility to include designers of buildings owned by not-for-profit organizations, Tribal organizations, and other tax-exempt entities

- Increased maximum potential deduction from $1.88 (2022 inflation-adjusted value) per square foot to $5.00 per square foot

These new standards apply to qualifying property placed in service after December 31, 2022.

The table below summarizes IRC Section 179D under prior law and the changes made by the Inflation Reduction Act of 2022.

Qualifying Improvements

Newly constructed or substantially renovated commercial buildings and residential rental buildings that are four-stories or higher are eligible for the deduction if qualifying improvements are made to at least one of the following three categories:

- Lighting system

- Heating ventilation and air conditioning (HVAC) and hot water system

- Building envelope

How Can an Organization Claim the IRC Section 179D Deduction?

Owners and tenants of commercial properties and residential rental buildings of four stories or higher that made improvements after January 1, 2006, are eligible for the deduction.

The deduction should be reported as a line item under other deductions on a tax return. Taxpayers must now also file a Form 7205 to support any claimed IRC Section 179D deduction. Taxpayers may also be able to claim the deduction related to a prior year on a current year tax return by requesting an accounting method change on a Form 3115.

A third-party contractor or professional engineer licensed in the state where the building is located must certify the energy performance of the building based on the standards set by the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE).

Increases Qualification Thresholds

A project must meet a 25% energy cost reduction threshold to qualify for any IRC Section 179D deduction. The base deduction is equal to 50 cents per square foot with a potential bonus deduction equal to $2.50 per square foot.

Additionally, the deduction increases on a sliding scale for each percentage point of energy cost reduction above 25%. This increase is capped at a 50% reduction with the base deduction set at $1 per spare foot and potential bonus deduction equal to $5 per square foot.

Previously, the tax deduction range was 63 cents per square foot for each of the three eligible systems, including HVAC and hot water, interior lighting, and building envelope to a maximum value of $1.88 per square foot.

Adds Bonus Deduction

The previously mentioned bonus deduction is available to companies that meet local prevailing wage and apprenticeship requirements for any laborers and mechanics employed by the taxpayer or contractors associated with the installation.

This rule only applies for buildings with construction starting after January 30, 2023. If the prevailing wage and apprenticeship requirements are satisfied or construction started prior to January 30, 2023, taxpayers may be eligible for the bonus deduction.

Updates ASHRAE Standard Requirements

The act now states that projects must be measured against ASHRAE Standard 90.1 affirmed from four years prior to completion of construction.

This is a change from previous provisions, which is the ASHRAE standard affirmed from two years prior to the start of construction.

Modifies Deduction Cap

The act creates a mechanism that allows for a taxpayer to pursue additional IRC Section 179D deductions as eligible upgrades are added to a building. Since 2006, there has been a lifetime cap of available IRC Section 179D deductions equivalent to $1.88 per square foot (inflation-adjusted amount for 2022). Once this cap was reached, additional IRC Section 179D deductions couldn’t be pursued for the building even if subsequent energy efficiency upgrades were made.

The act modified this rule to a three-year cap, allowing a taxpayer to claim IRC Section 179D deductions on upgrades if the previous full deduction claim occurred more than three taxable years ago.

Creates Alternate Deduction Path for Building Renovations

The act creates an alternate deduction path for renovation projects based on reducing a building’s energy-use intensity by 25% or more. This alternate path considers actual reduced energy costs associated with the upgrade rather than using the existing method of energy modeling. The energy modeling method is still an available option to evaluate the energy efficiency for renovations.

Can IRC Sections 45L Tax Credit and 179D Deduction Be Combined?

Yes, starting in 2023 IRC Section 45L credits may be claimed in combination with the IRC Section 179D energy-efficient commercial building deduction for qualifying residential rental developments that are four stories or more, where applicable.

We’re Here to Help

For more information on tax credits and incentives that can be used to combat climate change in the real estate industry, contact your Moss Adams professional.

You can also visit our Tax Credit & Incentive Services or Real Estate Practice for additional resources.